Enjoy a free transfer and a special welcome rate when you start using PassTo.

It only takes less than 120 seconds to create an account and start sending money.

Send up to £5,000 per day with unmatched real-time FX rates with no hidden fees.

From the ground up, PassTo has been designed to provide the highest levels of security.

To send money internationally with PassTo in a snap, please follow these simple steps:

Using the PassTo mobile app, it is quick and simple to send money. You can send money abroad with minimal effort.

PassTo can rapidly transfer funds abroad. The majority of money transfers are accomplished within minutes.

Depending on the service speed and quality in the target country, delivery may occur on the same or following working day in some instances. It enables you to expeditiously send money abroad, and in most situations, the recipient can access the funds within minutes.

If you are required to send money overseas rapidly, especially for urgent or emergency purposes, PassTo's swift money transfers can be a great resource.

PassTo typically offers highly competitive exchange rates compared to its rivals in the international money transfer industry.

To obtain a real-time PassTo quote for your international money transfer, you can use the PassTo website calculator or create a quotation inside the app. Simply select the destination country and enter the transfer amount, and the exchange rate, transfer fee, and final payout will be displayed. This is an excellent way to estimate and plan prior to sending money with PassTo.

PassTo transfer costs have been found to range from £1.40 to 2.50 The transfer fee charged by PassTo varies based on variables such as the destination country and the delivery service selected.

PassTo has transparent pricing. There are no hidden fees associated with PassTo's transfer fees, which are disclosed in a straightforward manner; and it offers highly competitive exchange rates and low, comprehensible transfer fees.

There is always a fee associated with international money transfers. Consequently, PassTo offers a competitive fee structure that is low and cost-effective. Additionally, there are no hidden fees, and PassTo maintains complete transparency regarding its fees.

Here are a few PassTo tips for minimising your transfer fees:

Within the application, you can monitor your PassTo money transfer.

Simply click on any transaction in your transaction history, and the PassTo app will provide you with the most up-to-date information regarding your money transfer. You can also configure your alert settings for timely updates. If you so choose, PassTo will notify you when your transactions advance to the next phase.

A number of safeguards are in place within PassTo to protect your funds and personal data at all times. PassTo implements the following industry standards to ensure the safety of your data:

PassTo takes their security policy very seriously, as evidenced by the aforementioned commitment to data privacy and safety.

We have a dedicated function (Head of Information Security) who constantly reviews and improves our measures to protect your personal information.

We have put in place appropriate security measures to prevent your personal data from being accidentally lost, used or accessed in an unauthorised way, altered or disclosed. All the measures are documented in a single document known as the IT Security Policy which includes BlaBla’s practices on acceptable encryption, information security review and audit, network security, data retention, archiving and destruction.

Our app uses industry approved protection tools (encryption, passwords) to protect your personal information against unauthorized access or disclosure. In addition, we limit access to your personal data to those staff members or other third parties who have a business need to know. They will only process your personal data on our instructions and they are subject to a strict duty of confidentiality.

We have put in place procedures to deal with any suspected personal data breach and will notify you and relevant supervisory authority of a breach where we are legally required to do so.

The method by which you fund your transfer is known as a payment method. PassTo allows the following types of payment:

These are all viable payment alternatives for your transaction. However, many international card issuers consider remittance payments to be cash advances, and you may incur additional fees.

Therefore, before you decide to use your international card to pay for your PassTo money transfer, verify with the financial institution that issued your card to determine if you will incur additional fees.

When sending money internationally, a payment method is the sender's payment instrument, whereas a delivery method is the recipient's equivalent. In other words, a delivery method is the means by which your recipient receives the remittance payments you send them.

PassTo supports the following delivery options for international money transfers:

Please be aware that the availability of certain delivery options may vary by country. If you use PassTo, you may find out what types of delivery solutions are available in your destination country.

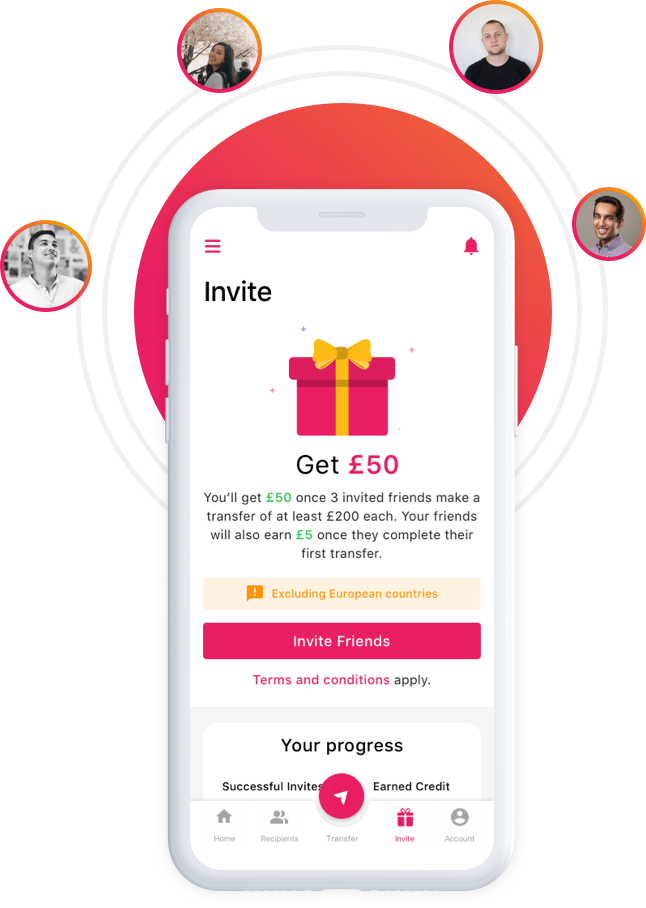

You can earn money and discounts by two attractive rewards programs

The PassTo loyalty and referral programs are an excellent opportunity for you and your friends to earn money and save on your transfers.