CurrencyFair is a money transfer service that allows customers to send safe international payments in 22 currencies, to over 150 countries. With over 13 years in business already, CurrencyFair has some 60,000 customers who value their speed, efficiency and low cost.

Our in-depth CurrencyFair review will tell you all you need to know, including CurrencyFair money transfer fees, whether it’s safe to use, how fast it is, how to get set up, and more.

CurrencyFair: Key points

Key features

- CurrencyFair is primarily a peer-to-peer currency exchange platform that allows you to send money to over 150 countries in 20+ currencies.

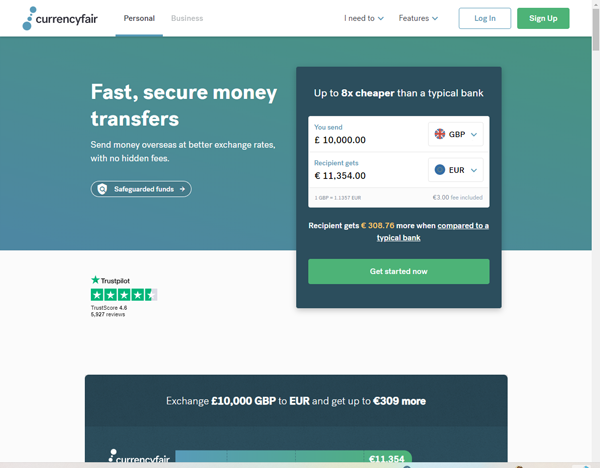

- The international payments have an average 0.42% exchange rate fee plus 3 euro transfer fee, which is relatively low compared to some other brokers.

- They offer online and in-app services, making it easy to pay by bank transfer and deposit the money into your recipient’s bank account.

Positives

- CurrencyFair offers excellent exchange rates on FXPal’s comparison engine.

- Users can choose their desired transfer speed and corresponding fee.

- Offers multi-currency accounts, which brings the platform close to being a bank account.

- The web and mobile app interface is clean and easy to understand.

- They have outstanding customer satisfaction rankings on TrustPilot.

Limitations

- Limited number of currencies supported.

- No debit card offered.

How does CurrencyFair compare to other foreign exchange platforms?

How good is CurrencyFair’s service?

CurrencyFair allows you to send money internationally in a unique way- by exchanging your currency with other CurrencyFair customers. This is as opposed to conventional methods such as going through a bank or money transfer company. CurrencyFair is unique in this way and is now the only major site which operates in this way since Wise (formerly TransferWise) moved away from this model in 2017.

This peer-to-peer approach is automatic and transparent, allowing you to select your own exchange rate. If another CurrencyFair user wants to exchange in the other direction and accepts your chosen rate, then that’s the rate you’ll both receive. Some users of the CurrencyFair marketplace even manage to occasionally obtain a more favourable exchange rate than the mid-market exchange rate!

If you don’t want to wait for another client to accept your offer, you may also select to convert your money at the highest feasible rate in the market right away. In any case, CurrencyFair provides top-notch exchange rates that are on average just 0.4%, or less, below the mid-market rate. At CurrencyFair, you can exchange between 22 different currencies. You’re also able to send money from and to over 150 countries; with recent expansion into Asia, this number is only going to increase. The company has local accounts for nearly all the supported currencies which makes transferring your money easy and free of charge (notable exceptions are United Arab Emirates and Canada where you will pay an intermediary bank fee).

After you convert your money using CurrencyFair, in most cases you’ll pay a small flat fee of around €3 to transfer the money out to the bank account of your choice. The transaction into CurrencyFair usually takes around one day, and then one to two working days for the recipient to receive the funds. For less popular currencies, this may take longer. You can exchange and transfer your money on the CurrencyFair website or mobile app at any time (except weekends and bank holidays) from anywhere. What’s more, CurrencyFair comes integrated with certain local interbank and bill payment systems in some countries, such as Australia and Singapore.

The multi-currency account feature of CurrencyFair is one of the standout capabilities of the platform. You can transfer money from another country, pay foreign bills, and get your salary or pension in a local bank account, in over 20 currencies. Outward payments can be made from these local bank accounts too and in the case of major currencies such as euros, pounds or dollars, the payments will normally arrive the same business day. In many cases this is a much more straightforward way of getting a local bank account than travelling to the country and proving to a local bank that you need an account, which involves going through extensive “know your client” anti-money laundering procedures etc. This feature brings CurrencyFair close to offering the same facilities as a bank (although it is treated as a fintech startup, not a bank, by regulators) but without the cumbersome bureaucratic procedures and high costs of a bank.

The website is available in English, German and French, and they employ customer service representatives fluent in these languages.

The only limitation on CurrencyFair, compared to a competitor such as Wise, is that CurrencyFair does not offer a debit card (virtual or real physical card) to withdraw funds with in any market. As long as this will not limit you, then Currency Fair should be on your shortlist for an international money transfer service.

How competitive are the fees and exchange rates offered by Currency Fair?

The margin fee is the variation between the real-time exchange rate and what CurrencyFair offers. When FXPal conducted a review of CurrencyFair, we noted that the exchange rate margin ranged from 0.25% to 0.45%. This is highly competitive against other foreign exchange brokers. To see for yourself on live prices, try a search on the front page of fxpal.com.

On occasion, even lower exchange rates may be possible through utilizing the CurrencyFair platform, if you get lucky with someone offering a good rate in the other direction.

Unlike with many other FX providers, transferring larger amounts will not result in any improvement in the offered exchange rates, which makes CurrencyFair arguably more suited to small transactions in the hundreds or thousands, up to tens of thousands of euros. Lastly, to state the obvious, CurrencyFair is an online-only platform, which means that the rates you see are what you get; you cannot ring up and try to negotiate a better rate!

How trustworthy is CurrencyFair?

CurrencyFair is long established, regulated, well-funded and big enough to be trustworthy. The company processes an estimated US$300 million in transactions per year for approximately 60 thousand customers.

CurrencyFair is a secure and reliable foreign currency solution for individuals, companies large and small. CurrencyFair’s main office is located in Dublin, Ireland with smaller presences across Britain, Singapore, Hong Kong and Australia – employing over 100 people globally in total.

Customers have used CurrencyFair to exchange more than €8 billion in currency. They have thousands of 5-star reviews on Trustpilot, with few complaints. With over €5 million net assets, the business is financially stable and has drawn roughly €20 million from investors.

CurrencyFair is a trustworthy money transfer service as a properly authorized financial services provider with over 60,000 current clients, established in 2009. CurrencyFair is both regulated and authorized by the Central Bank of Ireland, where it is headquartered. Under the European Communities (Payment Services) Regulations 2009, it is legally required to safeguard client funds and maintain systems and procedures at the highest levels. Being a global company, CurrencyFair is overseen by the appropriate local regulators in each country in which it has an office, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission and the Monetary Authority of Singapore.

According to the European Communities (Payment Services) Regulations, clients’ money is kept in segregated accounts that have no connection whatsoever to CurrencyFair’s own business accounts. So if anything unforeseen happens and the company starts to have financial difficulties, your funds will still be safe.

What do CurrencyFair’s users say?

The vast majority of reviews for CurrencyFair are positive, with customers citing the excellent exchange rates and quick response by customer service as the two main reasons for their satisfaction. They score 4.6/5 on TrustPilot.com, from an impressive 5,000 reviews at the time of writing (September 2022). The online platform also gets high marks for feeling safe and secure. There are a few negative reviews, mostly around verification issues and processes, but CurrencyFair has replied to all of them asking customers to get in touch directly to resolve any outstanding problems. Overall, it seems that CurrencyFair is a reliable and reputable currency exchange service that offers competitive rates and good customer service.

To summarize the comments we found:

Positive reviews

- Excellent currency rates

- Quick response by customer service

- The online platform appeared to be safe and secure.

Negative reviews

- A few individuals have attempted to sign up, only to find out their country isn’t supported.

- The compliance process occasionally is not instant, where the online ID verification system fails to match someone to their ID.

- The interface for the peer-to-peer marketplace can be challenging to use for less technically-inclined users.

We should highlight that CurrencyFair replies to all comments submitted on their Trustpilot page. When a negative review is received, its customer service provides an extensive response, often clarifying the client’s issues and providing further instructions, or inviting the complainant to contact their support department.

Guide to signing up and using CurrencyFair

Include own screenshots

The registration process

Documents required

How to use the CurrencyFair interface to exchange and transfer funds

CurrencyFair website vs. apps

Since 2015 CurrencyFair has had a mobile app. It is available on both Android and iOS platforms and the latest versions do almost everything the website can do. Among the app functionalities are:

- Capture and upload photo identification for identity verification purposes

- Check the status of their transfers

- Review historical transactions

- Currency transfers (either at the spot rate or a booked rate for peer-to-peer transactions)

- Manage your bank accounts and change your live exchange rates.

- You can also add, modify, or delete bank accounts with ease.

The CurrencyFair site provides one feature not present in the app: it allows customers to save, download, and print their currency balances or statements in a variety of formats, which is useful for those who want to monitor their finances more closely.

Other FAQs about CurrencyFair

Which is better, CurrencyFair or Wise (formerly TransferWise)?

They are both good.

Is CurrencyFair a bank?

It is a fintech startup, not a bank, however it offers multi-currency accounts which replicate most of the features of setting up a local bank account in different countries. Unlike a bank, the costs to exchange currencies are low. However, CurrencyFair does not offer debit cards.

How good is CurrencyFair?

It is an excellent foreign exchange provider. For some currency exchanges it is the cheapest on FXPal’s price comparison search engine results.

How do I send money to CurrencyFair?

Customers can send money to their CurrencyFair account by local bank transfer, which usually arrives the same business day. In the website or app click the “top up” link and follow the instructions.

Can you receive money on CurrencyFair?

Yes, you can send and receive money in 22 currencies in 157 countries.

How do I withdraw money from CurrencyFair?

Click the “Transfer Out” menu link in your account administration screen and enter the details for the bank account you wish to complete a transfer to.

Is CurrencyFair regulated?

CurrencyFair is regulated by the Central Bank of Ireland, where it is headquartered. Additionally it is regulated by the UK Financial Conduct Authority, Australian …. Under the European … directive customer funds are kept separate from the company’s funds…