Most international wire transfers use the SWIFT network. Banks across the world play a big part in these transactions1. My look into HSBC’s services showed a world where you need both knowledge and caution. When moving money abroad, you have to understand the fees and the role of different banks1.

I explored HSBC’s foreign exchange services to find out the real cost and transparency. At first, HSBC seems to offer a simple service for sending money abroad. But there are often extra fees. These come from intermediary banks, which can make things more expensive for you1. Anyone thinking about using HSBC for sending money abroad should think about these costs.

It’s key to know about the role of intermediary banks. In places like Australia or the EU, they often handle the transfers and deal with just one local currency1. This fact is crucial when looking at HSBC’s services. It helps make sure you get good rates and a service that fits your financial needs.

Understanding HSBC’s International Transfer Services

HSBC is a big name in international banking. It’s key to look closely at their services, especially the international transfer fees and speed. They usually move money within 1 to 2 days in the UK and Europe. For other places, it can take up to 5 days. Sometimes, there are delays because of other banks or holidays in the receiving country. Planning ahead is smart when you’re sending money around the world.

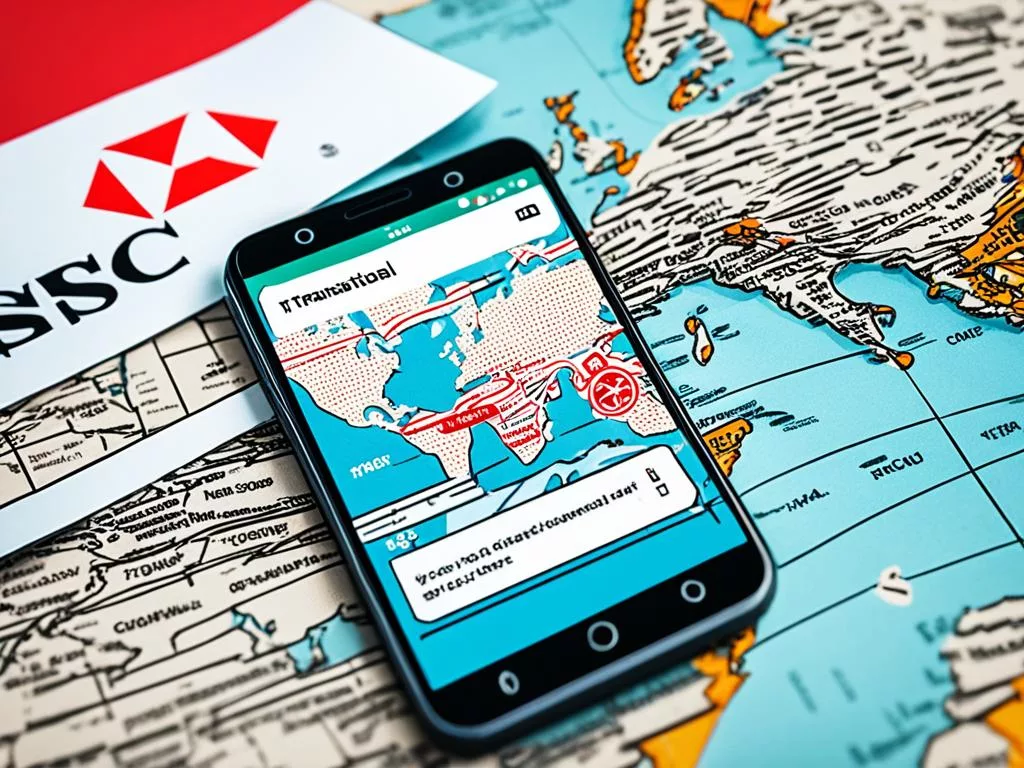

Using HSBC’s app, you can send up to £50,000. This limit is higher than many banks in the UK. But the catch is the high cost from not-so-great exchange rates. This is especially true for large transfers. Here, we also see fintech growing rapidly. A McKinsey report says fintech could grow much faster than traditional banks from 2022 to 20282.

In the battle with fintech, HSBC is not standing still. Fintechs might see a 15% revenue growth yearly, while old banks might only see 6%. HSBC introduced Zing to stay in the game. Zing lets you hold and transfer in over 30 currencies with up to 10 different currency accounts. It has low fees starting at 0.6% but changes with the size of the transfer2.

Looking at Zing, it’s clear HSBC is updating its services. They’re bringing in features to compete with fintech. By adding Zing, HSBC is moving forward. They’re making it cheaper and easier to send money abroad. This shows HSBC’s effort to keep up with new trends and meet their global customers’ needs.

Review of HSBC for Foreign Exchange and Transferring Money Internationally

When looking at transferring money internationally, we must weigh convenience against cost. HSBC brought out Zing to tap into the global retail payments market2. This app aims to challenge fintech companies, anticipating a 15% revenue growth yearly for five years2. This rate doubles the growth forecast for traditional banks at 6% per year2. It shows how fierce the competition is in international banking services today.

Zing lets users hold up to 10 currencies and spend abroad without extra charges at the point of sale. This proves HSBC’s commitment to offering handy HSBC transfer options2. It’s great for frequent travelers and those dealing with many currencies. Plus, Zing handles transfers in more than 30 currencies, expanding HSBC’s international services reach2.

HSBC’s Global Money Account allows holding funds in eight currencies. You can transfer money to other HSBC accounts for free2. These perks make things easier for HSBC customers. Yet, a foreign exchange review implies that HSBC might still cost more than some fintech alternatives. For example, Zing’s transfer fees begin at 0.6% and can change with the transaction value2.

When comparing HSBC international services to others, Zing charges a bit more for transferring GBP to EUR at 0.6%3. This is higher than Wise’s fee of roughly 0.45% for the same transfer. These small differences matter, especially for big transactions. But, HSBC’s Global Money Account does not have ATM withdrawal fees, which saves money when traveling4.

HSBC does have its drawbacks, like no support for direct debits or joint accounts4. When it comes to saving money and accessing multiple currencies, HSBC’s rates are often higher than other options in the UK4. It’s crucial to explore all HSBC transfer options before choosing how to send money.

Many people now turn to platforms like Monito to find better deals4. Monito serves millions every year, offering advice based on lots of data and expert analysis. It helps users cut down on fees and get more value when transferring money internationally.

In summary, HSBC’s Zing and Global Money Account make international dealings easier. But, a detailed foreign exchange review shows the importance of checking other providers for better rates. With fintech growing fast, customers have many choices to meet their global financial needs wisely.

HSBC’s International Money Transfer Speed

Learning about how international payment processing works is key for anyone in the global money trade. I checked out HSBC’s services, especially their digital tool, HSBCnet. It’s important for fast transfer speed and better user experience. HSBCnet’s cool feature is it lets you make payment templates. This means you save time and make fewer mistakes5. Also, its checks and formatted fields make payments quick and right5.

For handling lots of transactions, HSBC offers a File Upload option. This lets users send payment info fast, making the process smoother and bank transfer duration shorter5. Plus, with HSBCnet, you can set payments up to 45 days early. This makes sure money gets where it needs to, right on time5.

Also, for complex money moves across borders, tight security is vital. HSBCnet helps by letting businesses set who in their team can okay payments5. This tool stops mistakes and outlines who can approve payments, taking into account the payment size and time zones5.

Communicating about transactions is also essential. HSBCnet sends emails in many languages to up to six people after payment, keeping everyone updated5. It has a foreign currency service that makes sending money abroad smooth, showing HSBC’s all-around approach to international payment processing5.

HSBC also focuses on making it easier to manage money coming in. Their tool helps you either deal with receivables manually or use rules to monitor them5. They send clear emails about money coming in or invoice updates, showing HSBCnet’s practical support5.

| Feature | Impact on Transfer | Built-in Security |

|---|---|---|

| General Payment Templates | Time-saving on repetitive transactions | N/A |

| File Upload Feature | Enhanced processing for large volume payments | N/A |

| Timed Payment Instructions | Precise scheduling up to 45 days in advance | N/A |

| Payment Authorisation Tool | Real-time visibility and control over transactions | Protection against fraud and errors |

| Foreign Exchange Service | Streamlined cross-border transactions | N/A |

| Receivables Management | Simplified collections and tracking | Customisable notifications |

Knowing the details about HSBC’s services shows why their transfer speed and international payment processing are top-notch. Using HSBCnet can change how we handle international finances, setting new standards for bank transfer duration.

Advantages of Using HSBC’s Mobile Banking App for International Transfers

I always look for banking services that are easy to use and efficient. The HSBC mobile banking app is great for this. It lets me send up to £50,000 abroad easily. The app’s features like tracking transfers in real time and strong security checks are great. But, we also need to look at other things when using it.

When talking about costs for sending money abroad, it’s key to find a good deal. Zing charges 0.6% for changing GBP to EUR, while Wise asks for about 0.45%3. HSBC does not charge for replacing cards and might let you skip monthly fees6. The app works well for managing different accounts and getting help anytime from customer support6. HSBC has done a good job of providing a full mobile banking service.

HSBC’s worldwide reach is also a big plus. They have 22 U.S. Wealth Centers6 and are FDIC insured6. Their app makes it easy to send money to many countries. It also helps manage money in different currencies. This is really helpful for someone who needs to handle money around the world.

To sum it up, the HSBC mobile banking app is powerful for anyone needing to send money abroad quickly and safely. Its many benefits show how digital banking is changing to be more efficient and focused on the user.

Comparing HSBC to Other Providers for International Transfers

Exploring international finances, I noticed many companies offering transfer services. I looked closely at HSBC. It stands out for how it handles money across borders. It serves 19 markets, such as the USA, UK, and Australia7. Even as a giant in banking, with a cap of $10,000 for transfers to China, HSBC faces stiff competition.

When checking HSBC’s costs, consider more than just the limits and available currencies. The fees they charge are crucial. HSBC lets users hold currencies like EUR and USD, attracting clients worldwide7. It impacts over 39 million users in 62 places8.

Comparing HSBC to currency brokers, you see clear benefits, especially in savings and advice. If you spot any errors, tell HSBC within 60 days7. The bank’s Mobile App and Internet Banking make keeping track easier.

Looking at HSBC’s FAQ, you can learn about saving on costs. Despite HSBC’s size, with trillions in assets and thousands of staff by 20248, choosing a currency broker might save more money for transfers.

Below is a comparative table, showing HSBC’s global impact:

| Statistical Metric | Data (2023) | Global Relevance |

|---|---|---|

| Total Revenue for HSBC | US$62.611 billion8 | Reflects global earning strength |

| HSBC’s Assets | US$3.038 trillion8 | Indicates vast financial reservoir |

| Global Money Account Markets Supported | 19, including key financial hubs7 | Highlights extensive coverage |

| HSBC Rankings by Forbes | No. 20 in large companies8 | Underpins prestigious standing |

HSBC’s Transfer Limits and Their Impact on Your Transactions

HSBC’s transfer limits can make high-value overseas payments tough. This is especially true for buying property abroad. The £50,000 online transfer limit means clients might pay more fees and get worse exchange rates. This is because they have to make several transfers. It’s clear the limits on HSBC transactions can greatly affect big financial transactions. So, it’s wise to plan ahead if you’re moving a lot of money.

HSBC’s past problems with rules have made banks watch their steps. After paying $1.9 billion to U.S. regulators9, banks are very careful. They’re trying to stop money laundering and follow international laws9.

HSBC Premier customers can move up to £10 million. But, meeting the requirements needs some discussion. Yet, currency brokers might offer more flexibility without strict limits9.

Here is a table showing how HSBC’s limits and fines compare to other banks. It shows the challenges clients face with international transfers:

| Bank | Transaction Limits | Fines for Compliance Lapses |

|---|---|---|

| HSBC | £50,000 (Online) | $1.9 billion + $665 million civil penalties9 |

| Credit Suisse | – | $536 million (2009)9 |

| Barclays | – | $298 million (2010)9 |

| ING | – | $619 million (2012)9 |

| Standard Chartered | – | $330 million (2012)9 |

| BNP Paribas | – | $8.9 billion (2014)9 |

| Deutsche Bank | – | $258 million (2015)9 |

HSBC has strengthened its compliance team after being understaffed. But past mistakes still impact its policies, like transfer limits. These restrictions and careful checks, like customer ID checks, affect international payments today9.

To deal with these limits, consider talking to a financial advisor. Or, look into using a currency broker. This can help manage the challenges of HSBC’s international payment limits. Being informed and proactive is key to handling these constraints.

Exploring HSBC’s Launch of Zing: A New Money Transfer App

The financial world is always changing. HSBC keeps up by launching Zing, a new fintech rival. Zing is HSBC’s entry into the busy world of money transfer apps. It makes dealing with different currencies easier, supporting over 30 currencies and offering free services10.

Zing is not just another option. It’s designed as a top solution for UK people needing global money services. Users can store money in 10 wallets, useful in over 200 countries10. People like using Zing because it’s easy and works well. It has high transfer rates, showing its strong system and edge11.

HSBC launched Zing knowing it faces tough competition. Zing does international transfers in over 30 currencies and has 24/7 support. This shows HSBC values person-to-person contact in our digital world10.

| Zing Feature | Details |

|---|---|

| Multi-currency Support | Holds up to 10 currencies for use in over 200 countries |

| Conversion Fees | Ranges from 0.60-1% based on the currency |

| ATM Withdrawals | One free withdrawal per month outside UK; subsequent are charged at £2 each |

| Customer Support | 24/7 access to ‘real humans’ |

| Account Eligibility | Must be 18+, UK resident |

Though Zing is innovative, it differs from traditional banking. It’s not covered by the Financial Services Compensation Scheme10. This is a big change, aiming to compete with Wise and Revolut.

As people use digital options more, Zing stands out as a strong choice. Its fees are good, and it’s backed by a major bank. Zing shows HSBC’s commitment to modern, worldwide banking10.

The Feasibility of HSBC International Transfers for Different Currencies

I often look into financial services trends that drive innovation. I’ve seen that HSBC’s wide network makes it easy to do multi-currency transfers. This shows in the HSBC Global Wallet, making cross-border payments simple across various currencies like the Euro, British Pound, and Hong Kong Dollar12. This service highlights HSBC’s wide currency support, making transactions smooth across different economies. It also shows HSBC’s move towards the ISO 20022 standard for better communication12.

My use of HSBC’s real-time technology shows how easy managing cash flow has become12. Also, their work with the e-HKD project with the Hong Kong Monetary Authority places them ahead in adopting Central Bank Digital Currencies (CBDCs)12. They use patented technology to merge blockchain networks with their vast payment system12.

HSBC’s plan for regulatory compliance signals their strong readiness and responsibility in managing finances13. Detailed on December 17, 2021, the plan shows how connected their services are, like Global Markets and Personal Banking13. Looking into specific plans for financial systems, HSBC’s methods clearly support businesses in optimizing finances and planning cash needs accurately1213.

Source Links

- https://www.investopedia.com/ask/answers/062515/what-difference-between-correspondent-bank-and-intermediary-bank.asp

- https://www.forbes.com/advisor/money-transfer/hsbc-zing-money-transfer/

- https://techcrunch.com/2024/01/04/heres-how-hsbcs-new-international-payments-app-zing-compares-to-wise-and-revolut/

- https://www.monito.com/en/review/hsbc-global-money-account

- https://www.hsbcnet.com/about-hsbcnet

- https://www.forbes.com/advisor/banking/hsbc-bank-review/

- https://www.us.hsbc.com/checking-accounts/products/global-money/faq/

- https://en.wikipedia.org/wiki/HSBC

- https://www.investopedia.com/stock-analysis/2013/investing-news-for-jan-29-hsbcs-money-laundering-scandal-hbc-scbff-ing-cs-rbs0129.aspx

- https://www.which.co.uk/news/article/hsbc-launches-multi-currency-app-zing-can-it-save-you-money-on-holiday-aapup7S6Emi9

- https://finance.yahoo.com/news/hsbc-takes-aim-revolut-wise-192336621.html

- https://www.business.us.hsbc.com/en/insights/growing-my-business/financial-services-trends-driving-innovation

- https://www.fdic.gov/resources/resolutions/resolution-authority/resplans/plans/hsbc-165-2112.pdf