As I explore the world of global finance, I see how vital it is to know the time it takes to send money abroad. International wire transfers are becoming more common. So, understanding how long they take is key for managing money well.

In this guide, I’ll explain how international wire transfers work. I’ll also share the typical times they take. You’ll learn about factors that can change these times and possible delays. Plus, I’ll give tips for a hassle-free international money transfer.

Introduction to International Wire Transfers

International wire transfers are a trusted way to send money abroad. They help with personal, professional, or business needs across borders. These transfers move funds electronically from one bank to another, usually in 1 to 5 business days.

The time it takes can change based on the banks involved and their relationship. It also depends on the speed of the banks in between.

Knowing how international wire transfers work is key for managing money across borders. In 2023, cross-border payments are set to hit $190 trillion USD. By 2030, this number is expected to soar to $290 trillion USD.

This growth highlights the need for fast and reliable money transfer methods.

Transfers between North America and Europe are often quick. But, those between Europe and Africa might face delays due to extra checks. Issues like fraud or wrong recipient details can also slow things down.

To learn more, check out information on international bank transfer times. New tech has made some banks offer same-day or fast services. This can cut the average time to under 24 hours, under the right conditions.

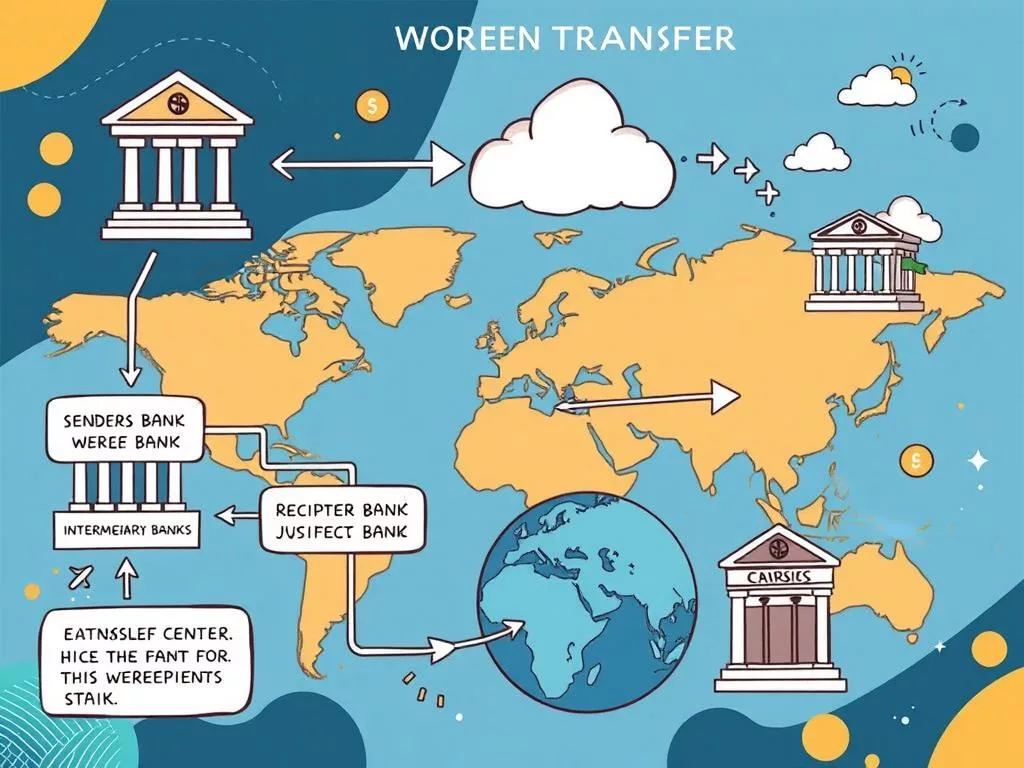

How International Wire Transfers Work

The process of sending money across borders involves several steps. First, I start by sending a transaction through my bank. I must give important details like the recipient’s name, address, and bank information. The SWIFT code is also needed.

This info lets the sending bank talk to the recipient’s bank. It’s all thanks to the SWIFT network. This network helps move money from one bank to another worldwide.

When the sending and receiving banks don’t know each other, extra banks might get involved. These banks help move the money but can add extra costs and slow things down. If the money is in different currencies, it will need to be changed. This can also affect how long it takes.

In the end, the whole process can take from 1 to 5 business days. Knowing how it works helps me plan better and avoid surprises.

| Step | Description |

|---|---|

| 1. Initiation | Provide details like recipient’s name, address, bank info, and SWIFT code. |

| 2. Processing | The sending bank communicates with the recipient’s bank via the SWIFT network. |

| 3. Intermediary Banks | Additional banks may be involved if the sending and receiving banks are not directly connected. |

| 4. Currency Conversion | If applicable, currency conversion will affect the total transfer time and fees. |

| 5. Completion | The funds are delivered to the recipient, typically within 1 to 5 business days. |

Average International Wire Transfer Times

International wire transfers usually take 1 to 5 business days. The time it takes can change based on a few important things. For example, transfers between North America and Europe often go faster.

Some banks offer fast services for a fee. This can cut the time down to 24 hours. This works best if the transfer is made during business hours and doesn’t need currency exchange.

To see how different methods compare, here’s a table:

| Transfer Method | Estimated Transfer Time | Transfer Fees |

|---|---|---|

| Wise | Same-day to 1 day | Flat fee of $7.43 + 0.57% variable fee |

| Western Union | 1-5 business days | Variable fees depending on the service |

| Popular Banks | 1-5 business days | Often hidden fees in exchange rates |

Wise is known for being clear about costs. A transfer through Wise costs about $172.74. This is much cheaper than traditional banks. Customers can also track their transfers and get updates.

Transfers can sometimes be delayed. This might be because of wrong details, system problems, or strict exchange rules. These can make the transfer take longer.

For more info on international wire transfers, check out this link.

Factors Impacting Wire Transfer Duration

Understanding what affects wire transfer times is key for anyone dealing with international banking. Several factors can influence how long a wire transfer takes. Knowing these can help me plan better.

- Relationship Between Banks: The bond between the sending and receiving banks matters a lot. Banks that work together often process transactions quicker.

- Intermediary Banks: Using middlemen banks can slow things down. Each one might need its own time to process.

- Currency Exchange: Swapping currencies can make things more complicated and time-consuming. Exchange rates change, which can affect how long it takes.

- Banking Infrastructure: The efficiency of the banking system in the destination country can vary. This affects how fast transactions are processed.

- Operating Hours and Time Zones: Different time zones and bank hours can make things tricky. If the transfer is made when the bank is closed, it might wait until the next day.

- Weekends and Holidays: Holidays and weekends can cause delays. This can make the whole process take longer.

- Errors in Recipient Details: Mistakes in the recipient’s info can cause delays or even stop the transfer.

International wire transfers can take from 1 to 5 business days. By understanding these factors, I can take steps to reduce delays. This ensures my transactions go smoothly.

| Factor | Impact on Transfer Time |

|---|---|

| Relationship Between Banks | May speed up processing for established partners |

| Intermediary Banks | Can introduce additional delays |

| Currency Exchange | Possible delays due to fluctuation and processing |

| Banking Infrastructure | Speed varies by destination |

| Operating Hours & Time Zones | Delays if initiated outside of bank operating hours |

| Weekends & Holidays | Can extend processing time significantly |

| Errors in Recipient Details | Can lead to delays or failed transfers |

Common Delays in International Transfers

Wire transfer delays can be really frustrating. They happen for many reasons, like banks checking for fraud. These checks, like KYC and AML, take time and slow things down.

Small mistakes in who you’re sending money to can also cause problems. If you get the account number or SWIFT code wrong, the transfer might fail. This means you have to start over, which adds to the wait.

Also, holidays and weekends can make things worse. Banks usually don’t work on these days. This means your transfer could take longer by a day or two.

Here’s a table that shows how different ways to send money work:

| Transfer Method | Duration | Fees (USD) |

|---|---|---|

| Traditional Bank Transfer | 1-5 days | $20 – $39 |

| OFX Transfer | 1-2 days | Flat fee: $3 |

| P2P Payments | 1-3 days | Varies |

| ACH Transfer | 1-3 days | Varies |

| Wire Transfers (Same Institution) | Less than 24 hours | Varies |

Knowing about these common delays can help make international money transfers smoother. By understanding what causes these delays, you can send money more efficiently. This way, your money will get to where it needs to go faster.

How Long Does It Take to Wire Money Overseas?

The time it takes to wire money abroad can change a lot. Usually, it takes from 1 to 5 business days. If everything goes right, like giving the right info and no banks in the middle, it can be as quick as 24 hours.

Things like fraud checks or changing money can slow it down. Transfers from North America to Europe are often faster. But, going from Europe to Africa might take longer because of extra checks.

Some banks can send money the same day for a fee. But, if the country has special banking rules, it might take longer. How I start the transfer, manual or automatic, also affects the time. Always check with my bank to know the usual time, which is usually 24 hours.

How to Effectively Send International Wire Transfers

To send money abroad, I first choose a trusted bank or wire service. It’s important to pick one known for reliable transfers. I then collect all the info I need for the recipient, like their name, address, and bank details.

Getting this info right helps avoid delays. It makes sure the transfer goes smoothly. I start the transfer online or in person, which is convenient. This way, I can talk to bank staff if I have questions.

It’s also key to follow all rules and regulations. Knowing the fees for each transfer helps with my budget. For example, traditional wire transfers cost about $44, but services like Wise can be as low as $6.42. Xoom charges a 5% fee plus a fixed currency fee, so it’s good to compare before you send.

After starting the transfer, I keep an eye on it. Letting the recipient know what’s happening helps them feel secure. Transfers usually take 1-2 business days, but some services like Xoom can do it in minutes.

Things like bank processing times and currency changes can slow things down. But, using trusted services and staying in touch with the recipient makes sending money abroad better.

Tips to Ensure a Smooth Transfer

Accuracy is key when making money transfers. I always double-check the recipient’s details before sending. A small mistake can cause big delays, so I try to avoid that.

Starting wire transfers during banking hours helps speed things up. Transfers made outside these times might take longer because of the bank’s schedule.

Knowing the fees for international transfers is important. I check if my bank or other banks charge extra. Using services like Wise or PayPal can save money, thanks to lower fees and better rates.

Being aware of things that might slow down transfers is also important. Bank holidays and time zone differences can cause delays. By planning ahead, I aim for smooth transfers, ensuring my money gets there quickly and safely.