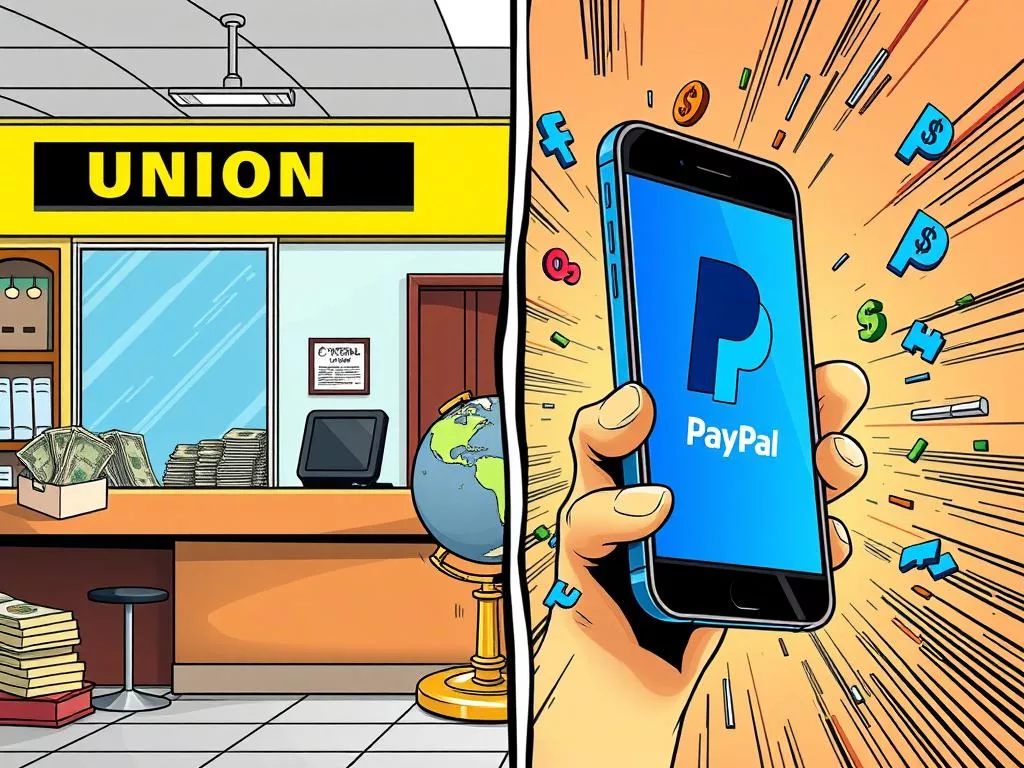

In the world of money transfer services and online payment platforms, knowing the differences between Western Union and PayPal is key. Both are big names in the market, serving millions worldwide with unique services.

Western Union is known for fast money transfers to over 200 countries. PayPal, on the other hand, has grown fast, with a revenue jump of 8% in the first half of 2024.

When you compare Western Union and PayPal, you see they both buy back stocks aggressively. This shows their management’s confidence. Yet, their financial strategies and market moves show their competitive sides. For example, Western Union has a market value of $4 billion and a 7.3% dividend yield. PayPal, with $18.3 billion in cash and investments, shows its strong market presence.

Understanding the Basics of Western Union and PayPal

Western Union and PayPal are top names in financial services. They help with global money transfers. Both are big in online transactions and payment systems.

Western Union has a huge network in over 200 countries. It has more than 500,000 agent locations. This makes it great for sending cash to many places.

PayPal, on the other hand, is all about digital payments. It has over 400 million active accounts. This makes it easy for online shopping and payments.

Western Union and PayPal meet different needs:

- Western Union is best for cash and physical locations.

- PayPal is great for digital payments and online shopping.

Fees for these services can differ a lot. PayPal’s fees are between 0.50% and 4% of the amount sent. Western Union might be cheaper for big transfers.

Here’s a quick comparison:

| Service | Specialization | Coverage | Transfer Options | Fee Structure |

|---|---|---|---|---|

| Western Union | Cash Pick-up | 200+ Countries | Bank/Wire Transfer, Cash | Varies, Generally Competitive |

| PayPal | Online Transactions | Global | Electronic Transfers | 0.50% to 4% Per Transfer |

Western Union and PayPal each have their own strengths. Your choice depends on what you need. Whether it’s Western Union’s wide reach or PayPal’s digital ease.

Guide to Western Union vs PayPal

When you look at money transfer rates between Western Union and PayPal, you see big differences. Both services have unique ways to send money across borders. This makes it key to compare Western Union and PayPal to find the best option for you.

PayPal is known for its financial health, with revenue up 7% in 2022 and 8% in 2023. It’s easy to use and makes customers happy. On the other hand, Western Union has a wide reach, serving over 150 million customers and having 525,000 agent locations worldwide.

Western Union is reliable because of its large volume and physical presence. This is important for places where digital services are not common. Even with a 9% revenue drop in the second quarter, Western Union remains big in the market. It offers services in over 150 locations in Hong Kong alone. Western Union’s fees can be from HK$5 to HK$30, which is more than PayPal’s charges.

Here’s a comparison of what Western Union and PayPal offer:

| Aspect | Western Union | PayPal |

|---|---|---|

| Market Capitalization | $4 billion | $68 billion |

| Revenue Growth | Decreased by 9% | Increased by 8% |

| Dividend Yield | 7.3% | N/A |

| Remittance Fees | HK$5 to HK$30 | Variable based on transaction |

| Processing Time | 1-5 working days | Instant to a few days |

PayPal is known for being easy to use and works well with online shopping. Both companies are good but serve different needs. PayPal focuses on digital payments, while Western Union has a strong presence in physical locations.

It’s also good to look at the competition. Services like Airwallex offer no fees and good exchange rates. You can learn more onWise’s blogand in thisguide.

Choosing between Western Union and PayPal depends on your needs. Think about the amount you’re sending, who you’re sending it to, and the costs. By understanding these differences, you can make a choice that fits your needs for sending money abroad.

Pros and Cons: Western Union vs PayPal

Western Union and PayPal have different strengths and weaknesses. Western Union is known for its wide reach, with over 550,000 agent locations in 200 countries. This makes it a reliable choice for those without bank accounts. But, it has higher fees and outdated features that might not appeal to tech lovers.

PayPal, on the other hand, is a leader in digital payments. It has over 400 million users worldwide and supports payments in more than 200 countries. It’s easy to use with online stores and fast, but it has fees. For example, sending money internationally costs 5%, and using a card adds another 2.90% plus $0.30.

PayPal is free for local transfers if you use a bank account or PayPal balance. But, its international fees can be steep. Western Union’s fees vary, depending on how you send money and where it goes. This can sometimes make it more expensive. For better deals, consider Wise or Currencies Direct. They offer competitive rates and clear fees. You can learn more about them in this guide to global money transfers.