In today’s digital world, moving money between apps is common. Many ask about transferring from Venmo to PayPal. Venmo and PayPal are both owned by PayPal Holdings Inc. but have different uses.

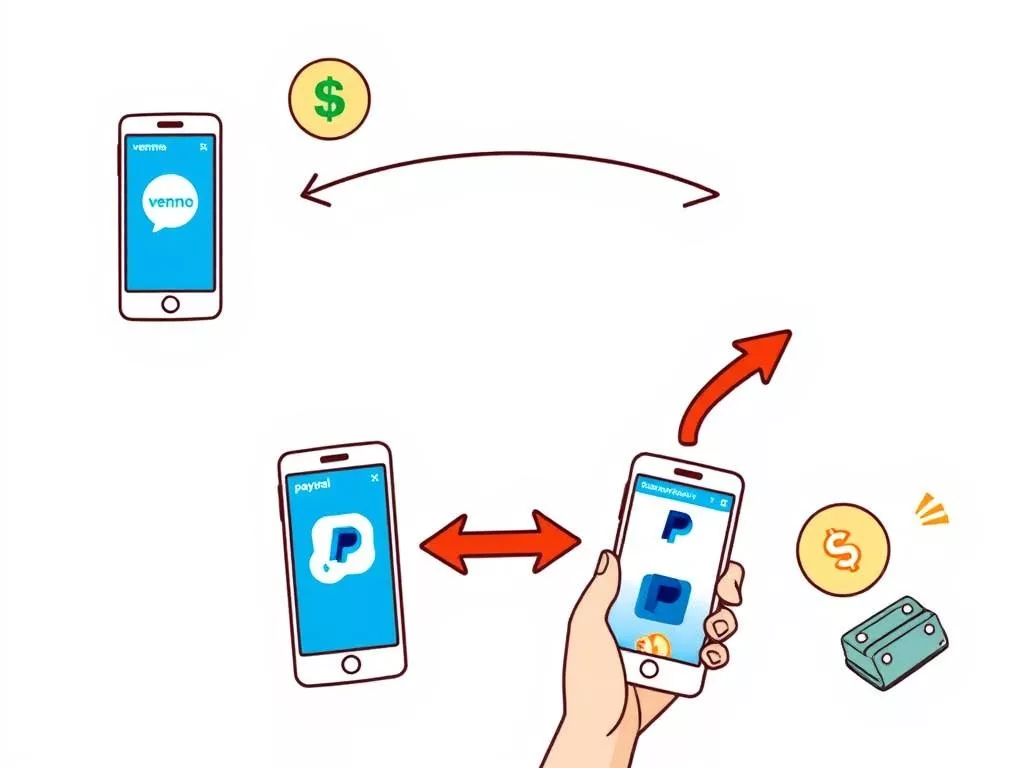

Venmo is great for sending money to friends and family. PayPal, on the other hand, handles payments worldwide for both people and businesses. Even though they’re owned by the same company, you can’t directly transfer money between them. This means you need other ways to move funds.

This guide will show you how to move money from Venmo to PayPal. It will also explain why people might want to do this, even with a 1.75% fee for instant transfers and a 1-3 business day wait.

Understanding Venmo and PayPal

Venmo and PayPal are part of the same company, PayPal, which bought Braintree in 2013. Venmo started in 2009 and became popular for its social features. It lets users send money to friends and family, adding emojis and comments to make it fun.

PayPal, on the other hand, is for both personal and business use worldwide. It offers more than Venmo, including interest-bearing accounts. This makes it better for managing bigger amounts of money.

Both platforms let you send money to friends and family without fees. But Venmo charges for instant transfers and credit card payments. Venmo’s instant transfer fee is 1.75% of the amount, up to $25.

You can fund Venmo with credit cards, debit cards, or bank accounts. Moving money from Venmo to PayPal takes a few days, as it goes through a bank account first.

Standard bank transfers on Venmo are free but take a few days. Venmo also has security features like encryption and a PIN. PayPal, too, offers easy transactions and lets you earn interest on your money.

Venmo focuses on mobile payments, while PayPal is more versatile for everyone. Knowing the differences helps you use each platform better for your needs.

Guide to Transfer Money from Venmo to PayPal

Direct transfers from Venmo to PayPal aren’t possible. But, you can use a linked bank account to get around this. This Venmo to PayPal transfer guide will show you how to do it smoothly.

To move money from Venmo to PayPal, start by linking your bank accounts to both services. This is key because you’ll need to move funds from Venmo to a bank account first. Then, you can move them from the bank to PayPal.

- Link Bank Accounts: First, make sure your bank account is connected to both Venmo and PayPal. This is essential for moving funds between the platforms.

- Transfer from Venmo to Bank: Next, transfer your money from Venmo to your bank account. Remember, Venmo charges a fee for instant transfers (1.5% of the amount, with limits).

- Move Funds to PayPal: Last, move the money from your bank account to PayPal. PayPal might charge extra fees for these transfers, depending on your account and history.

PayPal lets you add funds in several ways, including with its debit card. If you can’t use Visa+, you can order a PayPal Debit Card. Then, add it to Venmo for transactions.

For more on fees and steps, check out this detailed guide.

Step-by-Step Process for Transferring Money

To make transferring money from Venmo to PayPal easy, follow these steps. First, link your Venmo and PayPal accounts to your bank. This is key for smooth transactions.

- Linking Your Accounts: Open both the Venmo and PayPal apps. Go to settings to link your bank account to each. This makes transactions reliable.

- Transfer Money from Venmo to Bank: In the Venmo app, choose ‘Transfer to Bank’. Pick between Instant and Standard transfer. Instant transfers cost 1% of the amount, up to $10.

- Wait for the Transfer: Standard transfers take 1-3 business days. Instant transfers show up quickly but cost more.

- Deposit Funds into PayPal: After the money reaches your bank, open PayPal. Go to ‘Add Money’ and pick your bank. Enter the Venmo amount and finish the deposit.

This guide makes the Venmo to PayPal process easy. Remember, PayPal charges $0.30 plus 2.9% per transaction. This is important for those who make many transfers. For more financial tips, check out this article.

Knowing how online payment systems work can improve your experience. They offer easy interfaces, saved info, and more. Businesses can reach more customers with these tools.

This guide helps you understand the Venmo to PayPal transfer fully. Knowing about fees and times makes the process smoother. As e-commerce grows, learning these transfers is more important than ever.

Things to Consider

When you move money from Venmo to PayPal, it’s important to watch out for extra fees. Cross-currency transfers can add up, with both Venmo and PayPal charging extra for currency changes. For international money moves, Wise might be a better choice because of its clear fees and fair exchange rates.

Transfer fees are another big deal. Venmo lets you send up to $6,999.99 in seven days. PayPal’s limits can go up to $60,000, but sometimes it’s just $10,000. The type of transfer you choose affects the fee too. Instant transfers are quick but cost 1.75% on PayPal. Standard transfers are free but take longer.

It’s also key to make sure your personal info matches on both Venmo and PayPal. If it doesn’t, you might face delays or even legal trouble. Using the same bank account for both can help avoid mistakes. PayPal’s rules on fees and limits are important to know, as are their 4% fees for sending money abroad.