In this detailed Starling Bank review, we explore the many benefits and features that make Starling a leading digital bank. As a top challenger bank, Starling offers personal, joint, and business accounts online. These accounts have no monthly fees and are secure, accessible through a user-friendly mobile app.

Starling Bank has received high praise, scoring 9.2 out of 10 for being an excellent digital bank. It also gets a perfect 10 for its fee-free services in the UK and abroad. The service quality is rated 9.3 out of 10, showing its commitment to customer happiness, which is rated 9 out of 10.

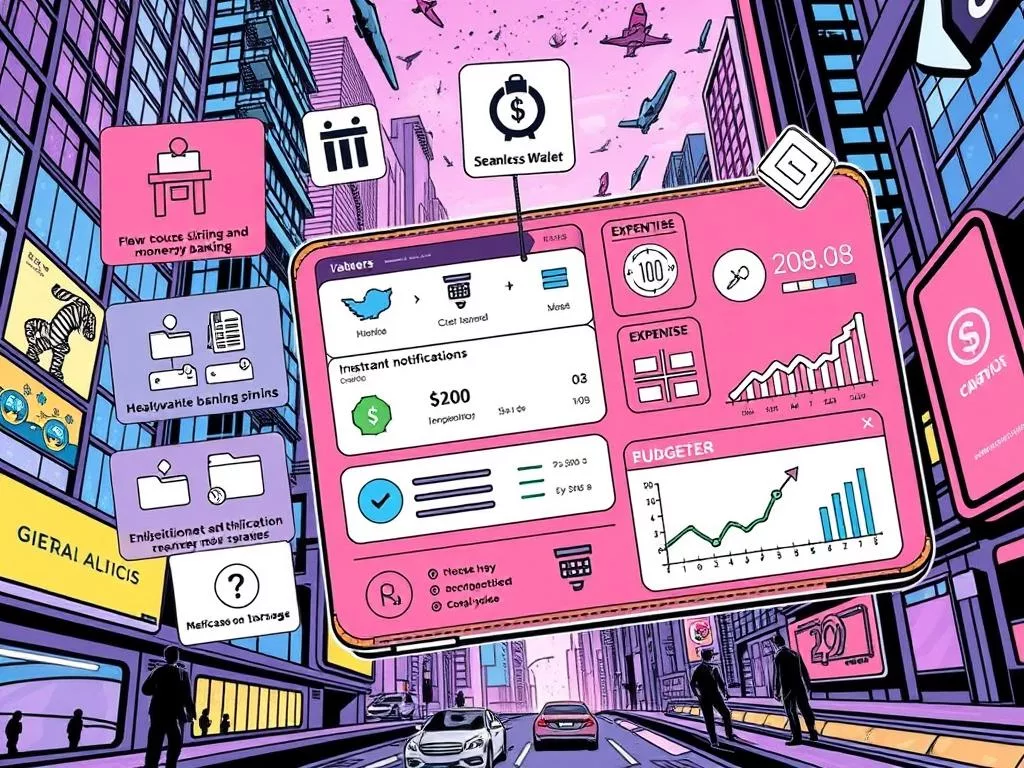

The Starling Bank card offers many perks, like real-time updates and budgeting tools. You can use the card worldwide without extra fees. Starling also uses recycled plastic for debit cards, showing its care for the environment.

The Starling Bank card review highlights the app’s ease of use. It offers 24/7 support and features like Spaces and Round Up for saving. With over 2 million customers, Starling continues to improve, making managing money easier.

As a part of the challenger banks sector, Starling has made a big impact. It focuses on lower fees, advanced technology, and a digital-first approach. For those looking for a modern banking option, Starling Bank is a great choice.

What is Starling Bank?

Starling Bank is changing the way we bank with its focus on users and technology. It’s a fully licensed UK digital bank that serves personal, business, and teen customers. The mobile app lets users manage their money easily, with instant updates and no extra fees for international transfers.

Starling Bank offers a wide range of financial products through online banking and mobile banking. Users can set savings goals, track expenses, and see how they spend their money. The app also supports Apple Pay, Google Pay, and Fitbit Pay for easy payments.

Starling Bank also cares about the environment. They make debit cards from recycled materials and work to cut down on carbon emissions. This makes them stand out as an eco-friendly UK digital bank.

Here are some key features and benefits of Starling Bank:

| Features | Description |

|---|---|

| Instant Notifications | Get updates right away for every transaction. |

| International Transfers | Send money abroad without extra fees. |

| Expense Categorization | Keep track of your spending with detailed categories. |

| Environmentally Friendly | Debit cards made from recycled materials. |

| Multiple Payment Options | Supports Apple Pay, Google Pay, and Fitbit Pay. |

Starling Bank’s mobile banking and online banking are known for being user-friendly and secure. It’s a favorite among UK digital bank users.

Starling Bank Card Features and Benefits

Starling Bank stands out with its unique features and benefits. It offers no-fee transactions on international purchases and withdrawals. This makes it perfect for travelers.

The Starling Bank app is full of useful digital banking services. It has Saving Spaces for budgeting, helping users save for goals. It also has instant fraud alerts to protect against unauthorized transactions.

Another great feature is the ability to deposit checks through the app. This saves time and fits well with Starling’s other services. The app also connects with financial planning tools. This helps users understand their spending and make better financial choices.

| Feature | Description |

|---|---|

| Saving Spaces | Set aside money effortlessly for specific goals. |

| No-Fee Transactions | Enjoy no fees on international purchases and withdrawals. |

| Instant Fraud Alerts | Receive immediate notifications of suspicious activity. |

| Check Deposits | Deposit checks directly through the banking app. |

| Financial Planning Tools | Analyze your spending and manage your finances effectively. |

Starling Bank Card: Guide to Western Union US to Philippines

Sending money from the United States to the Philippines is now easier. Starling Bank International Transfers work with Western Union. This guide to sending money abroad shows how to link your Starling Bank card with Western Union. It makes sure your money transfers are safe, fast, and affordable.

To start a transfer, link your Starling Bank card to Western Union. This mix of Western Union’s wide reach and Starling’s digital banking offers great rates and low fees.

| Service Provider | Transfer Fee (£) | Amount Received (USD) |

|---|---|---|

| Wise | 7.32 | 2,714.73 |

| Monzo (powered by Wise) | 13.28 | 2,706.61 |

| Barclays | 0.00 | 2,643.51 |

| Nationwide | 20.00 | 2,642.11 |

| PayPal | 6.99 | 2,567.69 |

Linking Starling Bank with Western Union makes transfers secure and fast. Starling’s app makes transactions smooth. It also keeps your money safe. The table shows Wise and Monzo have the best rates and fees.

Using Starling Bank for international transfers is cost-effective and offers great rates. It’s perfect for sending money to family or for business. This combo makes sending money easy and reliable.

Traveling with a Starling Bank Card

Traveling with Starling Bank has many perks. The card doesn’t charge fees for ATM withdrawals or transactions abroad. This makes it a cost-effective option for those exploring the world.

Starling Bank uses the Mastercard exchange rate for foreign transactions. This ensures you get a fair deal. It’s also smart to pay in local currency to avoid extra fees, as explained in this guide.

Managing your travel budget is easy with the Starling Bank app. You can sort your spending and set daily limits. This helps you keep track of your money while traveling. The app also has strong security to protect against fraud.

Starling Bank is a top choice compared to other travel cards. Wise and Revolut also offer fee-free withdrawals, but Starling Bank has no international banking fees. It’s known for being the Best British Bank for four years running.