Sending money to Maya Philippines is now easier with e-wallets and GCash. These services are known for being easy to use and having low fees. This guide will help you understand how to send money to Maya and make your experience better.

When you transfer money, knowing the fees and exchange rates is key. For example, sending from GCash to Maya costs about 15 PHP. You also need to verify your account to increase your sending limits. This means showing a government ID like a National ID or Passport.

If you’re sending money from abroad, compare exchange rates carefully. Services like Wise offer good deals with clear prices. This helps keep fees low and exchange rates fair for those in the Philippines.

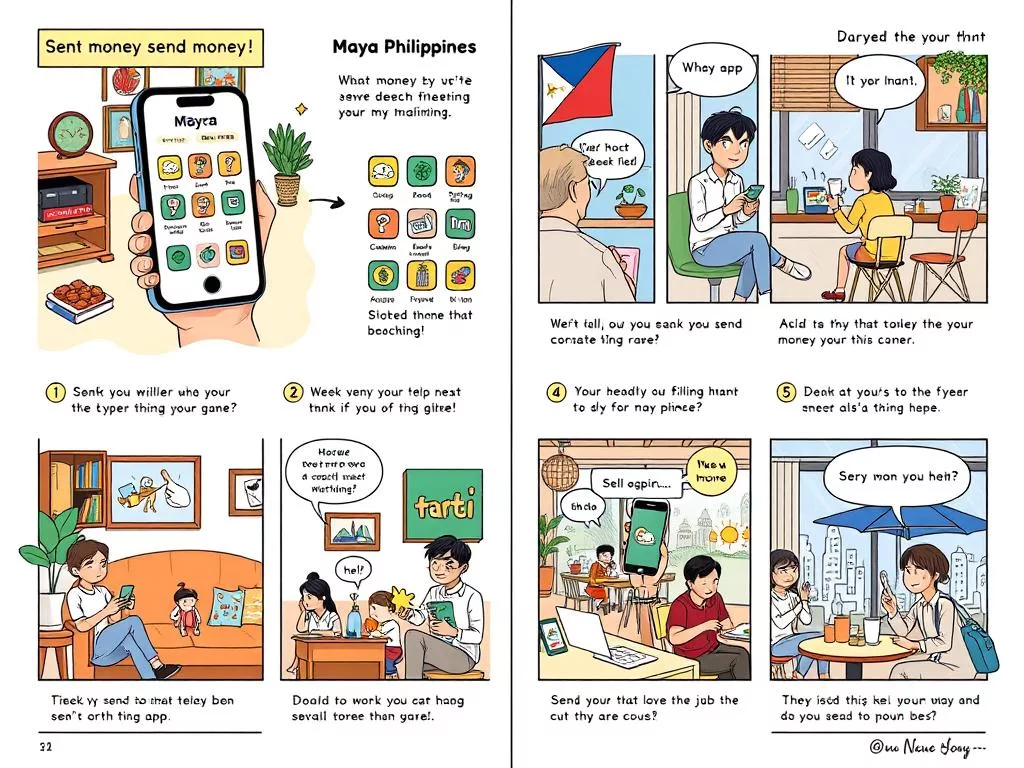

How to Send Money to Maya Philippines

Sending money from GCash to Maya in the Philippines is easy and quick. Follow this step-by-step guide to make it smooth and efficient:

- First, log into your GCash account on the GCash app. Make sure you have the latest app version to avoid problems.

- Navigate to the “Bank Transfer” page. Here, you’ll see many options, but we focus on Maya Philippines for this guide.

- Select “Maya Philippines” from the list of banks. It’s important to pick the right recipient to avoid transfer errors.

- Enter the amount you want to send. Remember, GCash charges a 15.00 pesos fee for each transaction.

- Input the recipient’s Maya account details correctly. Double-check the info to ensure a successful transfer.

- Confirm the transfer details. GCash will send a 6-digit code to your mobile for verification. Enter the code to continue.

- After confirmation, the funds will go to the recipient’s Maya account. The whole process usually takes just a few minutes.

For more help, check out a detailed GCash to Maya transfer guide online.

Learning how to use the Maya app and understanding money transfers in the Philippines can help. It ensures both sender and receiver have verified accounts to avoid transfer limits.

Mobile e-wallets like GCash and Maya are very popular. They are known for their ease and convenience. Always double-check transaction details and use available resources for a smooth transfer.

Guide to Send Money to Maya Philippines

Sending money to Maya in the Philippines is now easier thanks to e-wallets. Maya is the top choice for many Filipinos, with tens of millions using it every month. To send money from GCash to PayMaya, you need to follow some important steps.

First, you must verify your accounts on both GCash and Maya. For GCash, you need to upload a government ID and sometimes a video selfie. Maya also asks for valid ID to increase your spending limits. Both services make sure your account is secure and verified.

To start a GCash to PayMaya transfer, you need the right information about the recipient. The transaction is only good for one hour, so you must act fast. Maya will let you know if the transfer is approved or declined.

When sending money, remember the fees for online transfers. Even though GCash and Maya have good rates, it’s smart to check the fees. Here’s a table showing average costs for sending money to the Philippines:

| Service Provider | Average Cost |

|---|---|

| WorldRemit | ~1-2% |

| Remitly | ~1% |

| Western Union | ~1.5% |

| TalkRemit | ~1.5% |

| TransferGo | 1.5% – 3% |

| Instarem | 1% – 3% |

To send money smoothly, verify your accounts, know the recipient’s details, and check the fees. Making smart choices with these e-wallets will make sending money to Maya easy and reliable.

Understanding Fees and Conversion Rates

When you transfer money, you might face different fees and rates. It’s key to know the fees for using GCash to Maya services. Like other digital wallets, Maya’s rates can change based on the amount and transfer method. Also, the rates for converting currencies are important because they affect the total cost of your transaction.

Let’s look at some examples to see how different services compare. Monito, a tool for comparing finances, looked at 11 services for sending money from the USA to the Philippines. They found that users pay only 0.59% in fees and rates on average. This saves about $80 million compared to old ways of sending money.

For instance, currency rates can vary. They can be up to 1.46% better or 3.33% worse than the mid-market rate.

| Provider | Fees | Exchange Rate Markup | Speed |

|---|---|---|---|

| Western Union | $0 – Competitive fees | 0.5% – 1% | Minutes |

| Revolut | Low to zero fees | Up to 1% | Minutes |

| Wise (formerly TransferWise) | 0.5% – 1% | Mid-market rate | 1-2 days |

| GCash to Maya | Variable | 1.5% – 3% | Instant |

Wise money transfer is known for being clear about rates. It uses the mid-market rate, which can save a lot of money. On the other hand, banks like NAB and ANZ can charge up to 6% more for exchange rates.

Revolut has over 10 million online customers. They focus on quick and easy money transfers, often in minutes. They also offer zero fees or better rates for the first transfer. Digital banks like Maya and Tonik offer free services for frequent users, making them a cost-effective choice.

For more on transferring money, including with GCash, check out this detailed guide. It provides a thorough look at the process, helping you save money and make transfers smoothly.

Tips for a Smooth Transfer Experience

For a smooth and secure transfer to Maya, double-check the recipient’s details. Ensure the name, phone number, and account info are correct. This avoids delays and issues. Using reliable e-wallet services like Maya can also improve your experience.

Knowing when to transfer money is key. Some transfers may take longer or have different rates. By understanding these, you can send money at the best time. This ensures recipients get the most value. For better transparency and lower costs, consider using Wise.

Using tracking and notification features is also helpful. Services like PayPal offer solid tracking. This keeps you updated on your transfer’s status. It’s very useful for those sending remittances to the Philippines.

Lastly, choose a service provider you can trust. PayPal is a top choice for its security and global acceptance. Following online guides, like the Monito guide, can also help. It provides tips on sending money safely and confidently.