M-Pesa is a game-changing mobile money service launched in 2007. It’s offered by Safaricom and lets users send money in Kenya easily and safely. With over 52 million users, it’s a leader in digital payments in East Africa, also available in Tanzania and Mozambique.

If you’re in the United States and want to send money to Kenya, this M-Pesa guide will help. It explains the key steps and things to think about for international transfers. It also compares different services. Knowing how to send money quickly and safely is very important, whether you’re new to M-Pesa or not.

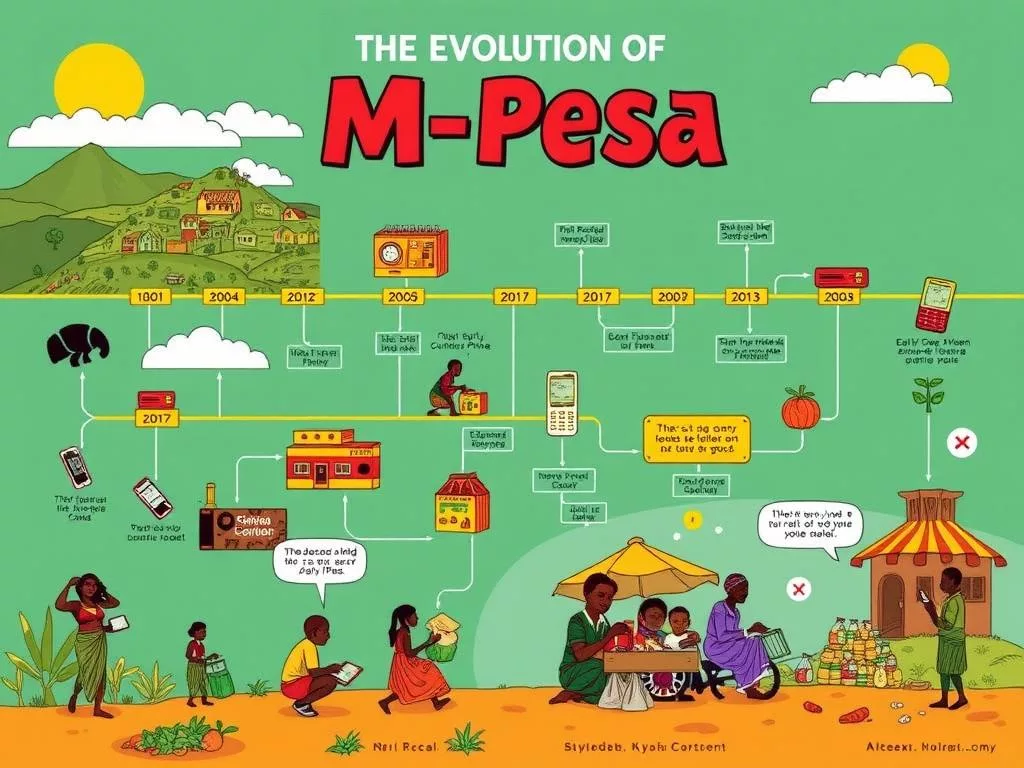

Understanding M-Pesa and Its Evolution

M-Pesa has changed the way people handle money in Kenya, starting in 2007 by Safaricom and Vodafone. It was first a small project to help those without bank accounts. Now, it’s a big part of making money easier for millions.

This service lets users keep, send, and get money, even pay for things and get loans on their phones. It works with many agents across the country. This has made it popular in Africa, too.

M-Pesa has grown to include international money transfers, even with cryptocurrency like USDT. These transfers are fast and often cheaper than banks, making it a good choice.

It also helps businesses by letting them accept payments easily. Safaricom and Asante offer loans to small businesses. This helps them grow with safe and easy credit options.

| Feature | Description |

|---|---|

| Launch Year | 2007 |

| Daily Transaction Limit | KShs. 500,000 |

| Maximum M-Pesa Balance | KShs. 500,000 |

| Single Transaction Limit | KShs. 250,000 |

| Deposits | Free of charge |

| Receiving Money | No charges incurred |

| Various Identification Documents Accepted | National ID, Passport, Military ID |

M-Pesa’s success shows how digital money can help more people in Kenya and beyond. It’s making money easier for those who need it most.

Guide to Send Money to Kenya via M-Pesa

Sending money to M-Pesa from the US is easy with some planning. You can use services like Western Union, WorldRemit, and Wise. First, you need to exchange USD for KES. Make sure the person you’re sending money to has an M-Pesa account.

To start, dial *840# or use the Safaricom app. This is key to begin the process.

- Opt-in to M-Pesa.

- Select the option to send money abroad.

- Enter the recipient’s phone number.

- Provide payment details including the amount.

- Confirm the transaction.

Transfers can be fast, often in minutes. Fees depend on the service and payment method. For example, sending up to 100 KSH costs 0.5 KSH. Sending 1,000 to 5,000 KSH costs 35 KSH.

There are many ways to get cash, like Mobile Money Agents or ATMs. The ATM process is quick, combining phone and ATM steps. M-Pesa is key for many Kenyans without bank accounts, helping them access services.

Learning how to use M-Pesa makes transfers easier and cheaper. Each method has its own fees and steps. So, it’s good to compare to save money.

| Method | Typical Fee | Maximum Amount | Withdraw Options |

|---|---|---|---|

| M-Pesa STK | Varies (0.5 KSH to 35 KSH) | 150,000 KSH (£750) | Mobile Money Agent, ATM |

| M-Pesa Super App | Varies (similar to STK) | 150,000 KSH (£750) | Mobile Money Agent, ATM |

| Safaricom App | Varies | 150,000 KSH (£750) | Mobile Money Agent, ATM |

| USSD *334# | Varies | 150,000 KSH (£750) | Mobile Money Agent, ATM |

Understanding M-Pesa and its channels makes sending money better. It meets the needs of people in the US and Kenya.

Comparing Different Money Transfer Services to M-Pesa

When looking to send money to M-Pesa in Kenya, many services offer unique features. Wise, Remitly, Sendwave, and WorldRemit are some of the top choices. Each has its own benefits.

Wise is known for clear exchange rates and low fees. This makes it a favorite for quick money transfers. WorldRemit also offers fast transfers and flexible ways to receive money, like bank transfers or cash pickups.

Sendwave is praised for not charging transfer fees. It’s a cost-effective option with a large user base. They keep fees low, with a markup of about 4% on the mid-market rate.

Here’s a comparative overview of these services:

| Service | Transfer Fees | Maximum Transfer Amount | Speed of Transfer | Supported Regions |

|---|---|---|---|---|

| Wise | Variable | No limits | 1-2 days | Global |

| Remitly | Varies by method | No limits | Minutes | Global |

| Sendwave | None | $999/day, $2,999/month (up to $2,999/day, $12,000/month after verification) |

Minutes | 11 African countries |

| WorldRemit | Variable | No limits | Minutes | Global |

When picking a service, think about fees and how fast money moves. Some services, like Sendwave, have limits for new users. This helps you find the best way to send money to Kenya.

Benefits of Using M-Pesa for International Transfers

M-Pesa has changed how we send money across borders. It offers many benefits of M-Pesa that people all over the world find useful. Even those without bank accounts can send and receive money with just their phones.

This is great for people who don’t have access to banks. It makes sending money easy and fast.

One big plus of M-Pesa is how fast it works. Money is sent almost right away. This is super helpful in emergencies.

Also, M-Pesa has a big network of agents. This makes it easy to get money in or out. It’s perfect for everyday needs and sending money abroad.

The M-Pesa app does a lot more than just send money. You can pay bills and even get loans. It’s cheaper than banks and helps people send money across the world. This makes it easier for people to manage their money and improve their lives.