Sending money to GCash in the Philippines is now easier than ever. GCash is the top digital wallet in the country, with 60 million users. It offers a safe and easy way to handle money. You can send up to ₱100,000, use it to pay bills, buy things, and send money to others.

This GCash guide will help you find the best ways to send money from the USA. We’ll look at the good and bad of different services. Whether you like online options or traditional banks, knowing the fees and benefits is key. Let’s see how you can send money to GCash easily!

Understanding GCash and Its Benefits

What is GCash? It’s a top digital wallet in the Philippines. It lets users do many financial tasks easily. You can transfer money, pay bills, buy mobile load, and apply for loans.

GCash is safe because it’s regulated by the Bangko Sentral ng Pilipinas (BSP). This means your money is in good hands.

GCash is more than just a wallet. It has over 60 million users. It helps people manage their money well. You can send money to others, making it easy for them to use GCash too.

GCash is secure, thanks to features like biometric verification. It follows BSP rules and laws to protect users. It also fights fraud by checking who you are.

The GCash app is full of useful tools. It helps you save, invest, and more. As tech gets better, GCash keeps making it easier to use money online in the Philippines.

| GCash Features | Description |

|---|---|

| Send Money | Transfer funds to GCash accounts instantly. |

| Pay Bills | Pay bills to accredited merchants directly from the app. |

| Purchase Load | Recharge mobile phones conveniently. |

| Loans | Access quick loan applications via the app. |

| Security | Advanced verification features to protect user data. |

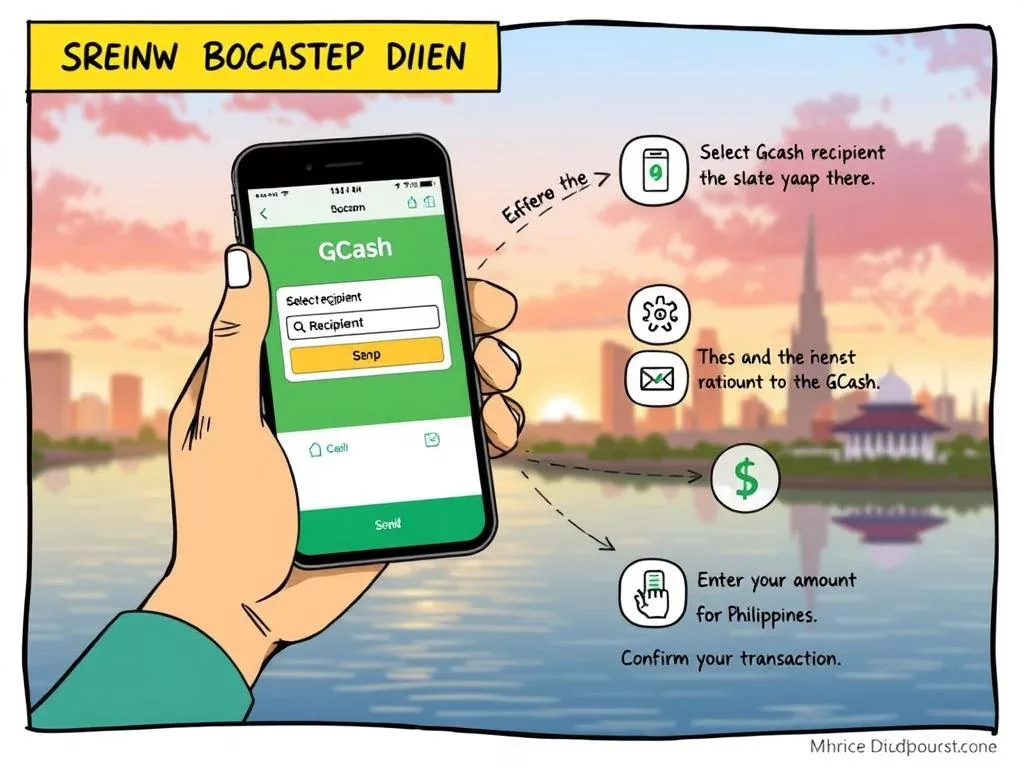

Guide to Send Money to GCash Philippines

Sending money to GCash is easy and can be done in just five steps. It’s perfect for anyone who needs to send money back to the Philippines. To send money to GCash, you just need to follow a simple process that makes transactions smooth.

- Create an account on a money transfer platform like Remitly or WorldRemit using your email address.

- Select the amount you wish to send, either in AED or another currency, while deciding on your preferred delivery speed.

- Choose the delivery method, confirming that the funds will go directly to the recipient’s GCash account.

- Enter the recipient’s name and GCash number, ensuring it’s formatted as 09XXXXXXXXX.

- Complete the transaction by submitting your payment details and confirming the transfer.

At first, users can enjoy special exchange rates, making the process even quicker. It’s important to know about fees and transfer limits from different services. For instance, Remitly offers Economy and Express transfers, with Express being faster. The fees depend on where you are, how you pay, and how fast you want the money to arrive.

Filipinos send over $30 billion in remittances each year, with GCash being a top choice. Upgrading your Remitly account can also increase your transfer limits. Knowing how to send money to GCash can save you time and money. It ensures your funds reach their destination quickly and safely. For more tips, check this guide on sending money to GCash.

Using Third-Party Services to Send Money

Sending money to GCash from the United States is easy with third-party services. Each service has its own features. It’s important to choose one that fits your needs.

- Remitly is known for its fast and affordable service. You can send up to $2,999, and the money arrives quickly. There’s a small fee, and using a credit card adds about 3%.

- WorldRemit is a reliable choice, charging around 1% for transfers. It’s fast, making it a top pick among money transfer services.

- Wise offers clear fees, starting at 0.33% for currency exchange. It gives you the mid-market exchange rate without hidden costs. Transfers might take 1-2 business days, but the clear pricing is a big plus.

- Western Union is a long-standing option. But, it often has higher fees and can take up to two business days for transfers.

Choosing the best service to send money to GCash depends on your needs. Wise and Remitly focus on user experience with good prices and speed. Traditional methods might be slower but can work well too.

Tips for Successful Transactions

When sending money to GCash, following some tips can make the process smoother. Always check the recipient’s details, like the GCash number format, to avoid sending money to the wrong person. A small mistake can cause big problems, so it’s key to double-check before you confirm the transfer.

It’s smart to compare fees and how long it takes to send money with different services. For example, BDO charges 10 PHP for sending to GCash online, but 25 PHP on their website. Also, watch out for exchange rates, as they can change a lot. Choose a service with good rates to save money. Some services might charge extra for converting currencies.

Using services that let you track your money adds security and clarity. It helps you keep an eye on your transaction. It’s also important for both the sender and the receiver to know any fees for sending or getting money through GCash. By following these tips, your money transfer will be easier and cheaper, giving you a better experience.