Sending money to Bangladesh is now easier and safer, thanks to digital services like bKash. Launched in 2010, bKash has changed how money is sent home. For those living abroad, a bKash Remittance Guide is key to know the best ways to send money.

Remittances are vital for families in Bangladesh, covering basic needs like rent and food. As living costs go up, using reliable services like bKash is more important. This guide will show you how to send money to bKash quickly and safely.

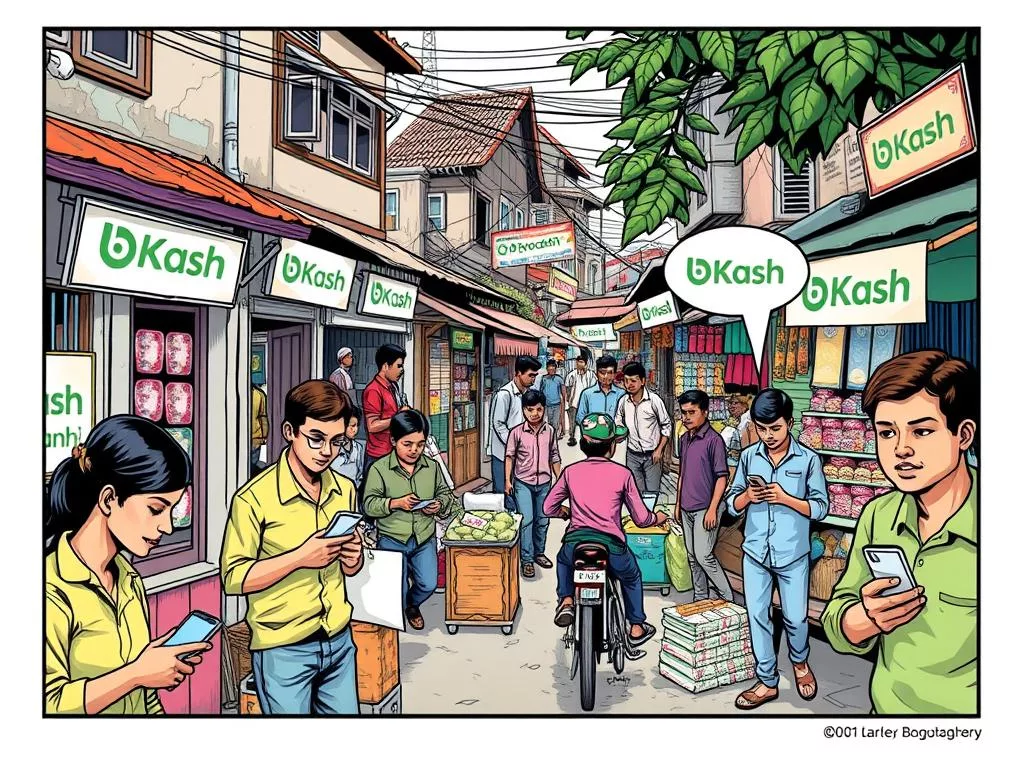

bKash has thousands of agents across Bangladesh, making it easy to use. Digital services like Paysend also offer low fees and good exchange rates. They make sending money abroad simpler.

This guide has been read 602 times, showing more people rely on digital remittances. As Bangladesh’s economy grows fast, bKash is key for financial inclusion. It helps local economies, even in rural areas.

The Significance of bKash in Bangladesh

Started in 2010, bKash has changed the way people handle money in Bangladesh. It has helped over 75 million people, making life easier for them. With bKash, people can now send money, pay bills, and even buy things online.

bKash has set up over 850,000 places where people can use their service. It’s easy to use and helps people do many things online. They even offer loans and ways to pay later, making life simpler.

bKash is also good for the environment. It uses digital receipts, which means less paper waste. This makes transactions faster and cheaper, helping Bangladesh reach its goal of more digital payments.

bKash is also key in sending money to Bangladesh from abroad. It’s fast and easy, helping families stay connected. The service is also part of Bangladesh’s plan to be more financially inclusive.

bKash is not just about mobile banking. It also has automated kiosks for easy access. This helps reduce the need for cash, making transactions smoother for everyone.

bKash has made a big difference in Bangladesh’s financial scene. It’s a big step towards a better financial future. Want to learn more about financial services in Bangladesh? Check out this guide to see how other countries are doing the same.

| bKash Statistics | Figures |

|---|---|

| Customer Base | Over 75 Million |

| Merchant Points | 850,000+ |

| Transactions | Paperless, with digital receipts |

| Financial Products | Digital Loans, Pay Later, DPS |

| Government Initiative | 75% digital transactions by 2027 |

| New Digital Banks | Nagad Digital Bank, Kori Digital |

Guide to Send Money to bKash Bangladesh

Sending money online to Bangladesh is now easier with mobile money services like bKash. Knowing how to use bKash makes sending money simple. Here are the steps to use bKash for fast money transfers.

- Account Registration: First, sign up with bKash. You can download the app or visit an agent. Have your ID and a Bangladeshi mobile number ready.

- Funding Your Account: Fund your bKash account before sending money. You can use linked bank accounts, debit/credit cards, or cash at agents. Domestic transfers in Bangladesh have fees from ৳10 to ৳100, based on the bank and amount.

- Initiating the Transfer: With your account funded, start the transfer. Choose ‘Send Money’ in the app, enter the recipient’s number, and the amount. Confirm and enter your PIN to send the money.

- Confirmation and Receipt: After sending, you and the recipient will get an SMS. The money is instantly ready for the recipient to use.

To understand bKash better, look at the fees for domestic and international transfers:

| Provider | Domestic Transfer Fees (৳) | International Transfer Fees (৳) |

|---|---|---|

| Standard Chartered Bank | 800 | 800+ |

| BRAC Bank | 300 – 1,500 | 300 – 1,500 |

| Dhaka Bank | 200 – 1,200 | 200 – 2,000 |

| Western Union | 0 – Competitive | 0 – Competitive |

| bKash | Lower fees for small transfers | N/A |

Understanding bKash for sending money online to Bangladesh can make it easier and cheaper. Whether it’s domestic or international, bKash ensures quick and efficient transfers.

Benefits of Using bKash for Remittances

Using bKash for sending money has many benefits, mainly for those living abroad. It’s easy to use and has a simple interface. The system is secure, ensuring money reaches its destination safely.

The fast remittance to Bangladesh feature is a big plus. It lets families get money quickly, which is very important for urgent needs.

For bKash for expats, it’s a great service. It works with banks and money transfer services from over 130 countries. This makes it easy to send money home.

In August, Bangladesh saw a big jump in remittances through mobile services like bKash. This shows how important bKash is for sending money home.

A big advantage of bKash is its low fees. People can get money from ATMs of 19 major banks for just Tk 7 per thousand. This is very helpful for those in remote areas.

bKash is also very popular because it’s easy to use and has a wide network. The service is available in both cities and rural areas. This makes it a good choice for sending money.

- Secure Money Transfer: bKash keeps your money safe during transactions.

- Fast Remittance to Bangladesh: You can send money quickly, helping your family in need.

- Wide Reach: bKash has many agents and ATMs, making it easy to use everywhere.

- Competitive Fees: bKash has low fees, making it a cost-effective way to send money.

In summary, bKash’s benefits, like its secure and fast money transfer, make it a great choice for expats. It helps them support their families in Bangladesh.

Challenges and Considerations

bKash offers many benefits for sending money in Bangladesh. Yet, users face some challenges and need to manage their expectations. One major bKash limitation is network instability, mainly in rural areas. This can make the service less efficient and reliable, causing mobile money issues for those who need smooth transactions.

Transaction limits and variable fees also affect bKash’s ease of use. Unlike services like Wise and Currencies Direct, bKash’s fees can be less clear. These remittance challenges in Bangladesh show the importance of checking costs before big transfers.

Using bKash also means dealing with limited statement filtration and account info features. This can make tracking expenses hard. The shift to digital receipts has moved us towards a cashless society. But, it also brings bKash transaction problems that need fixing. Customer feedback and ongoing UX improvements suggest solutions are coming. Users should keep up with the latest features to get the most out of bKash.