Sending money from PayPal to Western Union might seem hard at first. But, with some effort, it’s doable. This guide will show you how, with key points to remember. You can use bank accounts, PayPal Debit Mastercards, or Western Union Netspend Prepaid Cards to make the transfer.

Using a bank account for the PayPal money transfer takes 3-4 business days. On the other hand, the PayPal debit card for international money transfer is instant. But, it has a 5% foreign transaction fee and extra charges, making it pricey.

Western Union prepaid cards also have a $9.95 fee, adding to the cost. It’s important to consider these fees and transfer times. New financial tech like Wise offers lower fees, averaging 0.61%. Wise also does transfers in real-time, unlike PayPal’s long process with banks or Western Union.

Introduction to Using PayPal and Western Union for Money Transfers

PayPal and Western Union are top choices for digital money transfers worldwide. PayPal is known for its simplicity and digital focus. Western Union stands out for its wide network and cash pick-up options.

Every year, billions of dollars are sent from the U.S. to other countries. It’s important to have secure ways to send money abroad. PayPal lets you send money in over 200 countries and 25 currencies. You can link a bank account or card to your PayPal account for these transfers.

But, these steps can be complex. Services like Wise or MoneyGram often have lower fees than banks. They can transfer money almost instantly. Banks can take up to five business days, while apps like PayPal or Xoom are faster but not always accessible.

PayPal and Western Union have different fees and speeds. PayPal charges a 5% fee for international transfers, with a minimum of 0.99 USD. Card payments through PayPal have a 2.90% fee, both domestically and internationally. Western Union’s fees depend on the transfer’s destination, amount, and method.

It’s important to know these differences to choose the right service. PayPal transfers money quickly, while bank transfers take longer. PayPal and Western Union don’t directly transfer money, so understanding their processes is key to secure international transfers.

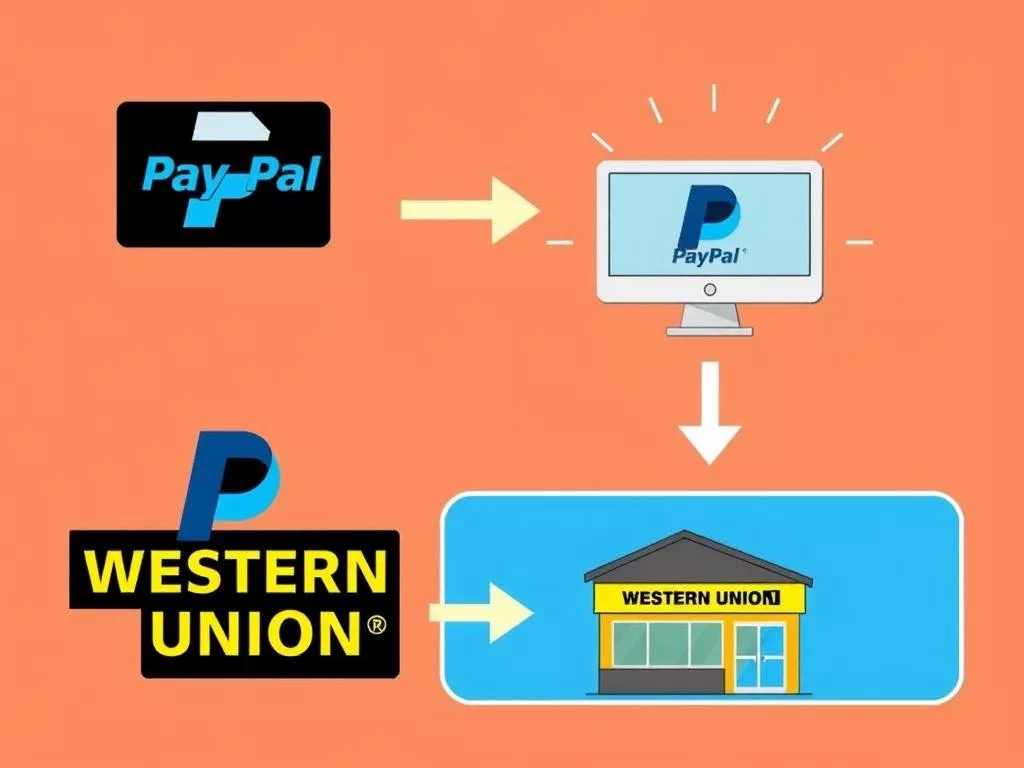

Guide to Send Money from PayPal to Western Union

Transferring money from PayPal to Western Union has a few steps. This online money transfer guide helps users send money abroad.

First, you need to link PayPal to a bank. You must verify your bank account, which might take a few days. After linking and verifying, you can move funds from PayPal to your bank account. Then, you can send it to Western Union.

Another way is using a PayPal Debit Mastercard. It makes transfers quicker but might have extra fees. Western Union also has a Netspend Prepaid Card for similar use, but it has its own fees too.

Let’s look at the costs of using banks versus other methods:

| Method | Cost | Transfer Time | Notes |

|---|---|---|---|

| Banks (average) | 13.40% | Varies | Average cost from The World Bank’s Quarterly Report, June 2024 |

| International Wire Transfer | $45 | Immediate | Typical cost from the U.S. |

| Wise | 0.43% to 1% | Instant to a few days | Exchange rates typically less than 1% using a bank account |

| Western Union | Varies, under $5 for | Within 24 hours | Fees depend on transfer type, location, exchange rate markups included |

Knowing these options and costs helps users make smart choices for sending money abroad. Services like PayPal to Western Union are reliable. But, Wise offers lower fees and fast transfers, which is key for international money moves.

Drawbacks of Using PayPal and Western Union Compared to Alternatives

PayPal and Western Union are well-known for money transfers. But, they have big drawbacks compared to other services. Users face many fees, like transaction and currency conversion fees. These fees can make transfers more expensive and less efficient.

For those seeking better options, Wise and Revolut are great choices. They offer clear pricing and use mid-market exchange rates. This means lower costs for users.

Transferring money between PayPal and Western Union can take a long time. Western Union has a wide network, but linking these services can cause delays. In contrast, Wise and Revolut focus on speed and saving money. They help users get faster, cheaper transactions.

Looking at different money transfer options shows modern services have big benefits. TransferGo, for example, has over 7 million users. It offers a smooth experience. Wise also supports over 50 currencies with clear fees, helping users know costs upfront.

This transparency is a big plus in a market where PayPal and Western Union have less clear pricing. It shows the value of newer, more innovative services for consumers.