In today’s digital world, knowing how to get a Mastercard is key. It’s important for secure transactions and global payments. This guide will show you how to get a Mastercard in Kenya, for both personal and business use.

Mastercard is a leader in payment solutions. It helps grow the economy and includes more people in finance. You’ll learn about Mastercard’s benefits, like top security and easy transactions. Getting your Mastercard opens up a world of financial chances.

Understanding Mastercard and Its Benefits in Kenya

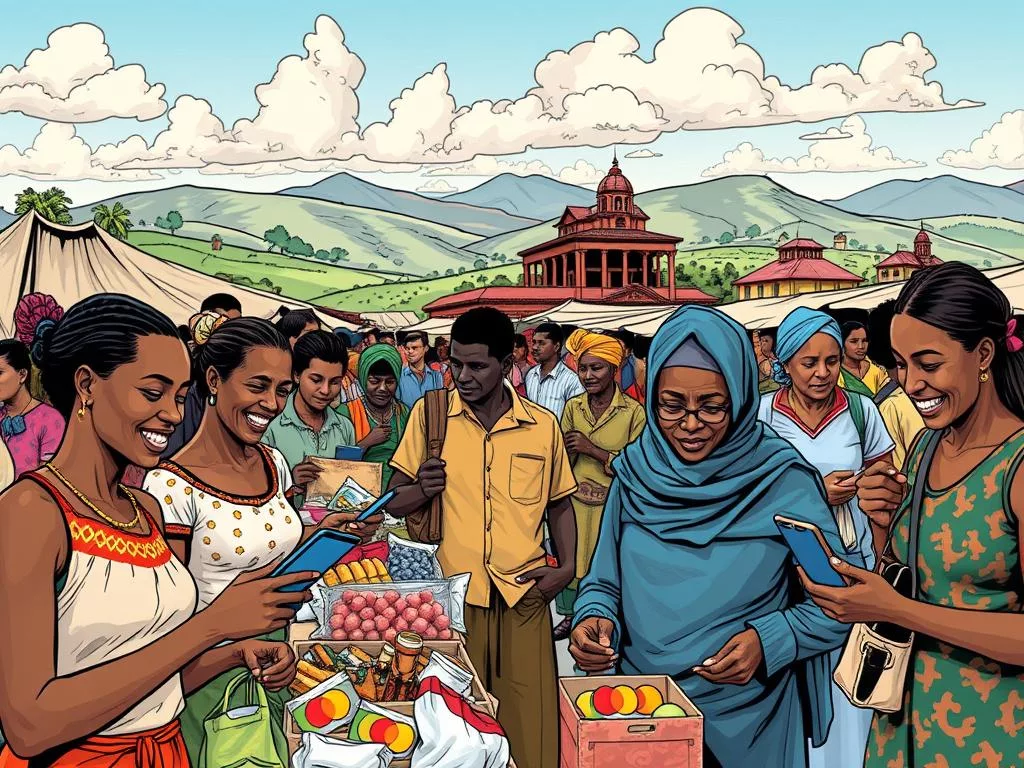

The benefits of Mastercard in Kenya go beyond just making payments. It helps more people and businesses join the economy. Mastercard offers services that fit the local market’s needs, helping both consumers and businesses.

Mastercard has a wide range of solutions to improve your experience. For example, there are different card types like Mastercard Silver and Mastercard World. This means you can pick a card that fits your budget and lifestyle.

Mastercard is also big on helping businesses grow. It gives them insights to attract more customers. This is key for small and medium enterprises (SMEs) to succeed.

The Mastercard Foundation works to empower young people in Africa. It aims to create jobs and boost local economies. The goal is to help 30 million young Africans by 2030.

Mastercard is always innovating to make payments better. It offers quick transactions and fraud protection. These efforts make financial dealings safer and more efficient for everyone.

To learn more about Mastercard’s role in finance, check out this guide.

Guide to how to get mastercard kenya

Getting a Mastercard in Kenya begins with choosing a bank that offers Mastercard services. Different banks have various Mastercard options. It’s important to research well before deciding.

When you apply, you’ll need to provide important documents. These include your ID, proof of income, and credit history.

The transaction process involves several parties: the cardholder, the merchant, the acquiring bank, and the issuing bank. Mastercard’s process makes transactions smooth from start to finish. It focuses on security, using advanced features like EMV chip technology and Zero Liability protection.

Many Mastercard options from banks like Paramount Bank come with rewards and travel benefits. These benefits make getting a Mastercard in Kenya more appealing, adding value and convenience.

Using your credit card responsibly can improve your credit history. This is useful for future financial needs. Mastercard offers a revolving line of credit, great for unexpected costs or emergencies.

To learn more about getting a Mastercard in Kenya, check out this detailed guide: how to get Mastercard in Kenya.

Optimizing Your Mastercard Experience

To get the most out of your Mastercard, check out all the features it offers. Look into rewards, cashback, and special deals. These can make your spending more rewarding and help with your budget.

It’s key to keep an eye on your spending. Reviewing your statements regularly helps you stay on top of your finances. This makes budgeting easier and more accurate.

Also, stay updated on any changes from your bank. New rules can lead to extra fees, which can mess up your budget. Keeping an eye on these changes helps you avoid surprises. If you have questions, don’t hesitate to reach out to Mastercard’s customer support.

To make your Mastercard better, use tools and strategies that fit your needs. For tips on loyalty programs and how they can help, check out Mastercard’s wide range of services. By following these tips, you can make your card work better for you and enjoy its many benefits.