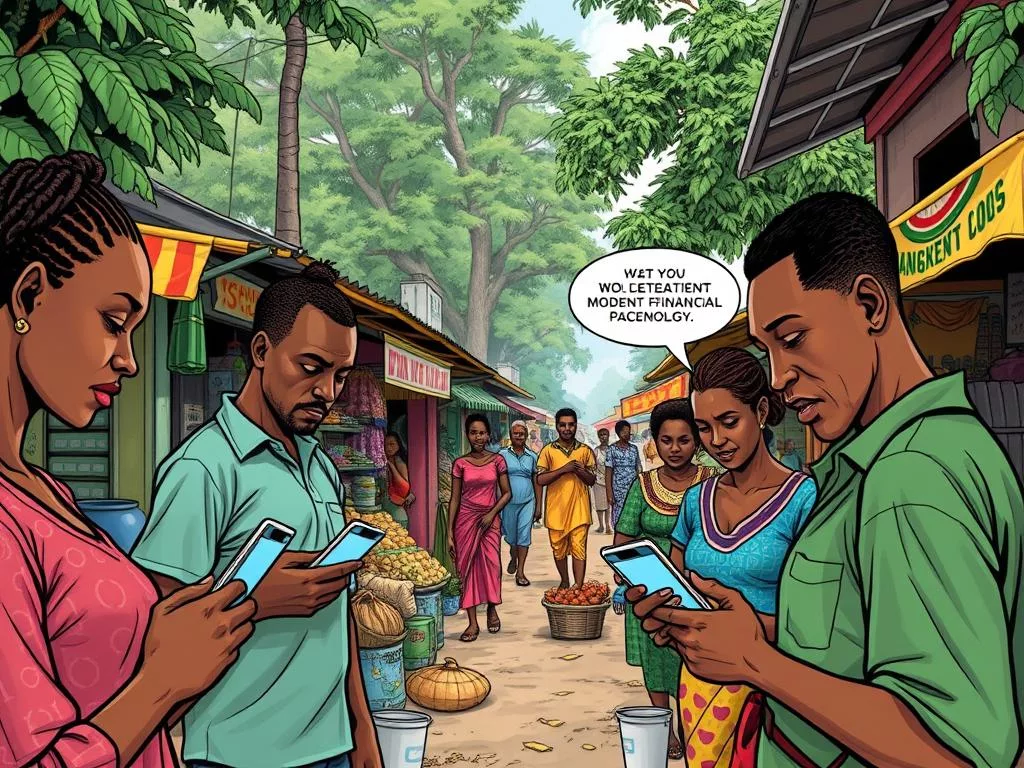

The world of mobile payments is changing fast. But many people wonder if Cash App Kenya is available. Cash App is a popular app for easy money transactions, like sending and receiving money, investing, and managing finances. Yet, Cash App is not available in Kenya or other African countries like Uganda and Nigeria.

This makes it hard for people in Kenya and other countries to use Cash App. They might look for other ways to send money or do transactions. For more information, check out this resource for options and solutions.

Understanding Cash App and Its Features

Cash App is a mobile payment app that has become popular. It offers features that make money transactions easy and simple. Users can send money to others without any fees, which is great for freelancers and businesses.

But Cash App does more than just send money. You can send cash or bitcoin instantly. It also lets you invest in stocks and cryptocurrencies. Plus, you can get a debit card that you can customize to manage your money.

One of the best things about Cash App is its direct deposit feature. It makes it easy to get your salary or payments right into your account. There’s also a feature called Cash App Borrow, which lets you get short-term loans. These loans are available for both iPhone and Android users, and they range from $20 to $200.

With Cash App Borrow, you pay a flat fee of 5% on the loan amount. You can repay it within four weeks. The app automatically takes payments from your linked accounts or debit cards. This makes it easy to repay your loan.

Cash App is part of a growing trend in mobile payment solutions. It simplifies banking and offers services that meet the needs of today’s users.

Guide to is cash app available in kenya

Cash App is popular in the U.S. for digital transactions. But, Cash App Kenya faces challenges. It’s not directly supported in Kenya. Users trying to send or receive funds may face obstacles like no official support and security risks with VPNs.

Setting up Cash App requires some care. You need a U.S. phone number for registration. Even then, users might hit card verification issues, mainly if their cards don’t fit Cash App’s payment systems.

International payment systems like Cash App have security and efficiency issues. Users might struggle with quick fund transfers available in the U.S. The Instant Deposit feature on Cash App allows debit card transfers with a 1.5% fee. But, this might not work for Kenyan users.

- Cash App supports Visa and Mastercard, making it accessible for users with these cards.

- Transfer fees for instant transfers range from 1% to 1.5%, essential to note for those considering the costs.

- Security features, including biometric options and encryption, enhance safety for users, though limited in Kenya.

Given the constraints, users might look at alternatives like M-PESA. M-PESA is a strong digital payment solution in East Africa, launched in 2007. It makes it easy for Kenyan customers to get international payments, including from the U.S. Platforms like Wise also offer electronic transfers to M-PESA, with low, clear fees and fast processing. For more details, check out this resource.

Alternative Options for Mobile Payments in Kenya

Kenya has many mobile payment options for safe and easy transactions. If you’re looking for something other than Cash App, try M-Pesa, Airtel Money, or Intasend. These services offer a range of features for different needs, making them top choices in Kenya.

M-Pesa is a leader in mobile payments. It lets users send and receive money, pay bills, and buy goods from merchants. With millions of users, it’s a big name in the market. Airtel Money is also popular, focusing on making payments easy and improving user experience.

Intasend is known for its wide range of payment options, including Visa and Mastercard. It’s praised for quick customer service, unlike big companies that take longer. It’s great for freelancers and e-commerce sites, making international payments easy, including Shopify connections.

Here’s a table showing the main features of top mobile payment services in Kenya:

| Platform | Key Features | User Target |

|---|---|---|

| M-Pesa | Money transfers, bill payments, and merchant transactions | General public |

| Airtel Money | Transfers, payments, and rewards programs | Airtel users |

| Intasend | International payments, Visa & Mastercard support, and user-friendly interface | Freelancers and e-commerce businesses |

These digital wallets in Kenya show there are many mobile payment options. Users can try these alternatives to find the best fit for their needs, whether personal or business.

Challenges of Using Cash App from Non-Supported Countries

Users in countries like Kenya face big challenges when trying to use Cash App. They can’t access key features like sending money or withdrawing funds. To open an account, they must provide a Photo ID and Social Security number.

Not getting verified can freeze your account. This makes it hard to send money across borders.

There are also limits on how much you can send or receive. You can only send £250 in 7 days and receive up to £500. These limits can be a problem for those who need to send money internationally.

Linking local bank accounts is also tough. This limits the flow of money needed for daily activities.

Looking for ways to use Cash App can lead to scams or unauthorized downloads. These risks can harm your financial safety. Even with Bitcoin, there are strict limits, like a daily cap of $2,000 and a weekly limit of $5,000.

For more on international payments, check out this article. It offers tips on making money transfers easier.