In today’s global economy, finding the best international money transfer options for businesses is key. These options help us manage cross-border transactions efficiently and cost-effectively. Thanks to technology and finance advancements, businesses can now expand globally with ease.

When choosing a service for business money transfers, I look at features, costs, and benefits. Traditional banks charge high fees, around 13.40% of the transfer amount. On the other hand, services like Wise charge less than 1%. Knowing these differences helps me make smart choices for my business.

Understanding International Money Transfers

International transfers are many ways to send money across borders. They include bank wire transfers, online platforms, and mobile apps. Knowing how these work helps us choose the best option.

In today’s world, most money is digital. This makes sending money abroad easier and faster. But, international transfers are more complex than local ones. They take longer because of different banks, time zones, and steps involved.

Currency exchange is key in international transfers. It’s not a big deal in local ones. Sending money abroad can cost a lot due to exchange rates and extra fees.

Businesses need international transfers to buy goods, pay bills, and more. Banks often charge a lot for these services. But, apps like Afriex offer better deals. They don’t charge fees and have good exchange rates, saving businesses money.

Understanding these points helps us handle international money transfers better.

Why Choose Specialized Money Transfer Services?

Choosing specialized money transfer services has many benefits over traditional banks. Companies like Wise, OFX, and Xe offer better deals for international money moves. They charge less, keeping more money in your pocket.

Unlike banks, these services don’t hide fees or charge high exchange rates. This can save you up to 3.5% on each transaction. For example, in Australia, Canada, Europe, and the U.S., bank fees can reach $20 or more.

These services are easy to use, perfect for businesses needing fast and safe money moves. They offer flexible payment options, speeding up transactions. Wise, for instance, has great exchange rates and many payment choices, making small to medium transfers quicker.

| Provider | Recommended for | Support | Typical Fees | Exchange Rate Type |

|---|---|---|---|---|

| Wise | Small to medium transfers | Online support | Low fees | Mid-market rate |

| OFX | Transfers above $7000 | 24/7 telephone support | Low fees | Competitive |

| Revolut | Common currencies | App support | Varied | Excellent rates |

| TorFX | Large volume transfers | Telephone support | Low fees | Competitive |

| TransferGo | European transfers | Online support | Lowest rates | Market rate |

In short, specialized money transfer services make international money moves better. They save you money, speed up transactions, and offer a smoother experience.

Looking for the Best International Money Transfer for Businesses?

Choosing the right international money transfer service is key for a business’s finances. It’s important to know the options to make a good choice. I aim to break down these solutions and find the best fit for your business needs.

Western Union has been around for 170 years, serving over 200 countries. They offer online, in-person, and bank-to-bank transfers. You can pay with debit/credit cards or bank transfers.

Wise is known for low-cost transfers with real exchange rates. It’s great for both individuals and small businesses. PayPal is perfect for e-commerce with its protection for buyers and sellers. Routable offers advanced features for businesses needing automation.

Let’s compare some top international money transfer services:

| Provider | Transfer Methods | Key Features | Ideal For |

|---|---|---|---|

| Western Union | Online, In-Person, Bank-to-Bank | Global network, multiple payment options, cash pickup | Businesses needing reliable service with extensive reach |

| Wise | Online Transfers | Mid-market exchange rates, low fees | Individuals and small businesses managing currency |

| PayPal | Online/In-App Payments | Buyer protection, easy integration with e-commerce | E-commerce businesses managing transactions |

| Routable | Mass Payments | Advanced vendor management, AI invoicing | Businesses requiring automation and compliance |

When choosing, look at what each service offers, where they operate, and their costs. Use tools like Western Union’s price estimator. Also, compare Wise and PayPal’s features to find the best for your business.

Key Factors to Consider in Money Transfer Services

Choosing a money transfer service for my business requires careful thought. One key thing is understanding the fees involved. Services like Wise Business offer clear pricing, with fees starting at 0.33%. This makes it easier to decide.

It’s also important to compare these fees with what traditional banks charge. Banks often have higher fees.

Looking at exchange rates is another must. Good rates can mean more money for the person I’m sending it to. This can help my business stay profitable. Companies like Xe offer great rates and low fees, making them a cost-effective choice.

When it comes to transfer speed, some services are faster than others. Wise Business suggests 1-2 business days for international transfers. This is important for making timely payments.

Lastly, I need to think about security in money transfers. Top providers use strong security, like encryption and two-factor authentication. Knowing about these security steps helps me trust my chosen provider. It keeps my business transactions safe from fraud.

| Feature | Wise Business | Xe Money Transfer | Western Union |

|---|---|---|---|

| Fees | From 0.33% | Competitive rates | Higher fees |

| Exchange Rates | Transparent pricing | Favorable rates | Less favorable |

| Transfer Speed | 1-2 business days | Similar speed | Varies |

| Security | High-level security features | Standard security measures | Advanced security protocols |

Before making a choice, I compare different services. This helps me pick the best one for my business. Knowing these key points leads to better choices and a smoother experience with international money transfers.

Top International Money Transfer Providers

Choosing the right provider for international money transfers is key. The top providers offer unique features for different needs and preferences.

Wise is known for its clear pricing and fair exchange rates. This means users can avoid hidden fees. It’s great for those who want to save money when sending money abroad.

OFX offers no transfer fees but has slightly higher exchange rates. It’s good for those who value transaction efficiency over upfront costs.

Xoom, from PayPal, focuses on speed. It’s perfect for urgent money transfers. You can send money to a bank or a cash pickup location fast.

MoneyGram and Western Union are traditional choices. They have wide networks and offer services like cash pickups and direct bank transfers. They’re reliable and work in many countries.

Here’s a quick look at some top providers:

| Provider | Fees | Exchange Rates | Transfer Speed | Coverage |

|---|---|---|---|---|

| Wise | Low, transparent | Mid-market | 1-2 business days | Over 70 countries |

| OFX | Zero transfer fees | Higher markups | 1-5 business days | Over 55 currencies |

| Xoom | Varies | Varies | Minutes to hours | Over 130 countries |

| MoneyGram | Varies | Varies | Minutes to days | 500,000+ locations worldwide |

| Western Union | Varies | Varies | Minutes to days | 200+ countries |

Providers like Ria Money Transfer and Currencies Direct are also worth considering. They offer services to over 190 countries and have high ratings. Each provider meets different needs, showing the need to research well.

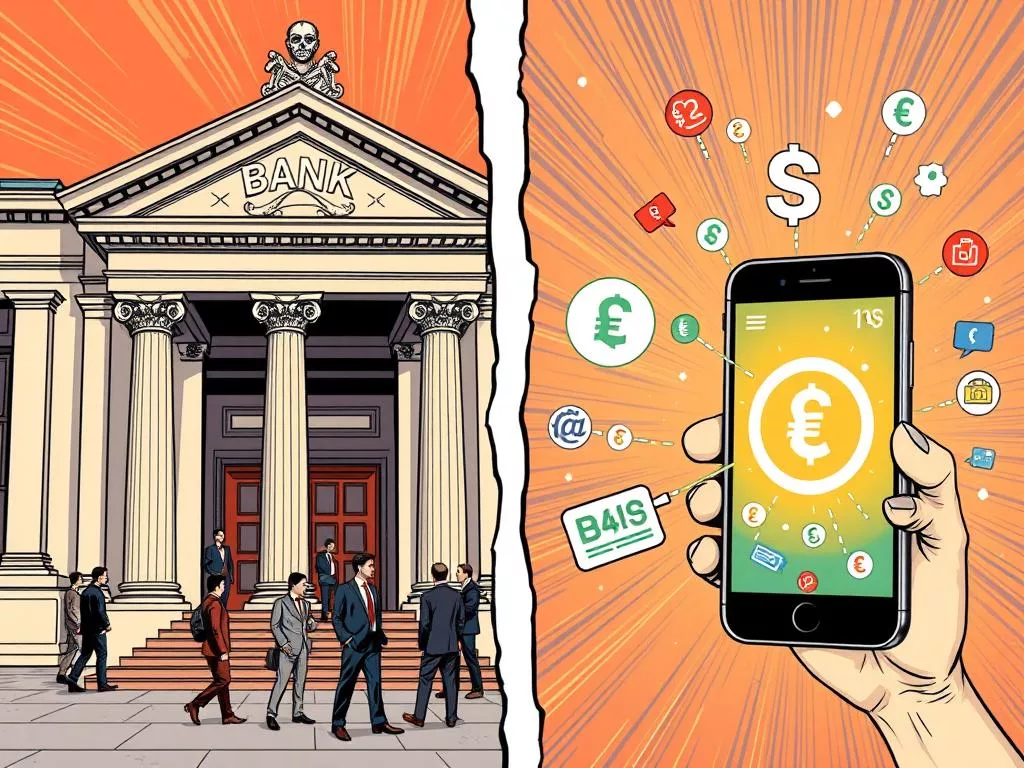

Comparing Traditional Banks vs Money Transfer Apps

Choosing between banks and money transfer apps changes how you send money abroad. Banks are known for their reliability but often charge a lot for international transfers. They also give less favorable exchange rates, which can reduce the amount sent.

Money transfer apps, like Wise and TransferGo, offer faster and cheaper services. They have lower fees and better exchange rates. Wise is great for businesses in different markets because it lets you send money in many currencies. These apps are often faster than banks, with transfers happening right away or in a day.

Here’s a comparison of banks and money transfer services:

| Service | Countries Served | Transfer Speed | Typical Fees |

|---|---|---|---|

| Western Union | Over 200 | Instant | Variable |

| Wise | Over 170 | 1-2 days | Low, depending on amount |

| TransferGo | Over 160 | 1-3 days | Low, competitive |

| PayPal | 110 | Instant | High for some transactions |

Apps like OFX don’t have limits on how much you can send, which is good for businesses. They are easy to use, perfect for companies that send money abroad often. Plus, they work well with accounting software, making things easier for businesses.

Businesses looking for fast and affordable ways to send money should think about their options. It’s important to know the benefits of money transfer apps over traditional banks. For more on local bank transfers, check out this link.

How to Choose the Right Service for Your Business Needs

Finding the right money transfer service is key for your business. It’s important to ask the right questions. Think about how often you need to send money, how much you send, and where you send it. Knowing these details helps you make a smart choice.

Comparing different providers can show you what sets them apart. Some offer better exchange rates, which can change due to market and global events. Digital services aim to match these rates in real-time. Using international remittance services can boost your earnings and reach more customers.

Look at the fees each service charges. Banks often have high fees, up to USD 60. But digital services try to keep costs low. How fast a transfer is made is also important. Slow transfers can harm your business. Some services can send money instantly or the same day.

Good customer support is also key. A service that’s available 24/7 can help with any problems. Being able to send large amounts of money without limits is also a plus for growing your business globally.

In the end, comparing rates, fees, and limits helps you pick the best service for your business. Taking the time to analyze these factors ensures a smooth and secure money transfer for your company.

Common Challenges in International Money Transfers

International money transfers come with their own set of challenges. One big issue is transaction delays. These can be caused by many things, like bank processing times and regulatory checks. This can make the transfer take anywhere from one day to five working days.

Another problem is hidden fees. Banks and other service providers often charge extra without telling you upfront. A 2020 World Bank report found that bank fees for international payments can be as high as 11%. It’s important to check any payment platform for hidden costs.

Currency changes also add to the complexity. Most providers charge more for exchange rates, leading to unexpected costs. To deal with this, I plan carefully and choose a provider with good rates. I also budget for rate changes and use forward contracts to protect against currency shifts.