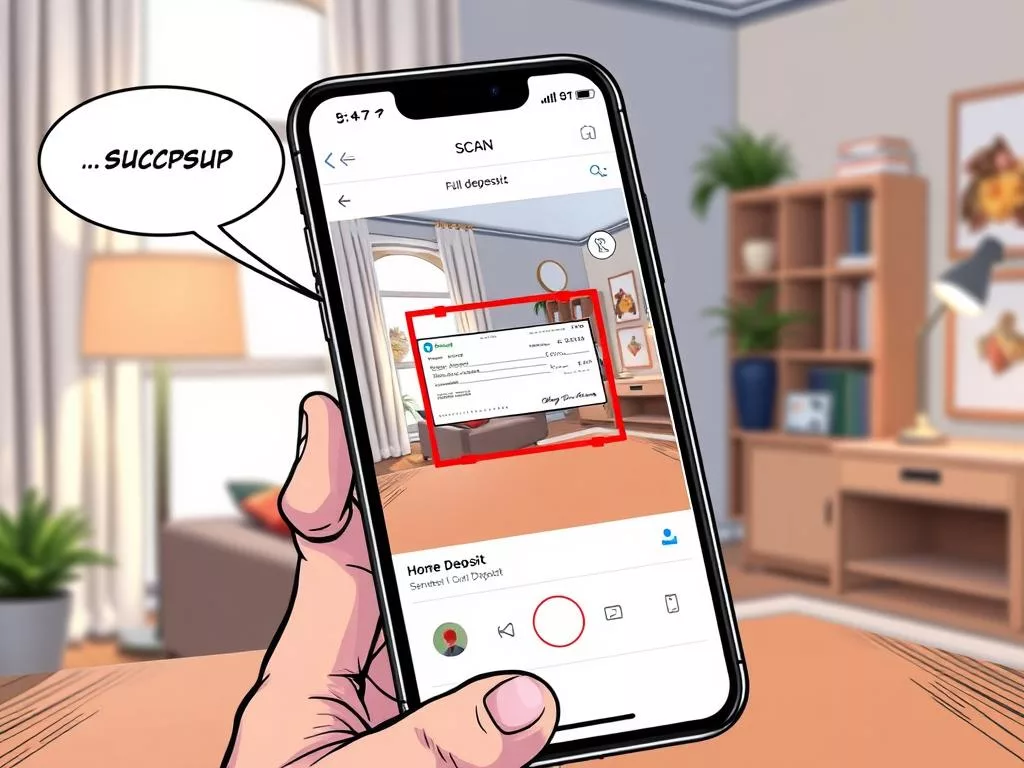

In today’s fast world, mobile banking is key for many. Mobile check deposit lets you deposit checks with your phone. Just endorse the check, snap a photo, enter the amount, and send it off.

This service is common among top banks, making banking easier. But, deposits take one to five days to process. Some banks, though, offer quick access or same-day deposits for certain transactions.

A study by the American Bankers Association found 48 percent of customers like mobile apps for banking. Banks offer features like automatic savings and virtual assistants to meet today’s needs. Alliant Credit Union and Huntington Bank stand out for their mobile deposit services.

It’s important to check mobile deposit limits and online banking features when choosing a bank. This ensures you find one that meets your financial needs.

Understanding Mobile Check Deposit Features

The Check Clearing for the 21st Century Act of 2004 started mobile check deposit. Now, you can deposit checks through your phone. This means you don’t have to go to a bank or credit union.

Mobile check deposits usually take one business day to process. Some banks offer quicker service for a fee, but most take one to two days. Each bank has its own rules for how much you can deposit at once.

When you deposit a check, the timing and your account status matter. Deposits made outside of business hours or on weekends take longer. Also, checks over the limit or not eligible for mobile deposit can cause delays. Knowing these details helps make mobile banking better for everyone.

| Bank/Credit Union | Daily Limit | Immediate Processing Fee | Next Day Availability |

|---|---|---|---|

| Navy Federal Credit Union | 10 checks, $50,000 | No fee | Yes |

| Bank of America | Varies | No fee | Yes |

| Key Bank | Varies | 2% | Yes |

| TD Bank | Varies | 2% | Yes |

| Regions Bank | Varies | Up to 4% | No |

| U.S. Bank | $50 for accounts | No fee | No |

Guide to best banks with mobile check deposit

Choosing the right bank with mobile check deposit features can make banking better. Many top banks offer this service, letting you access your money fast. This guide will show you the best options, what they offer, and their key features.

1. SoFi: SoFi is known for its great rates. Its mobile app gets a 4.8 on the App Store. Users love how fast they can get their money with mobile check deposits.

2. HSBC: HSBC offers a reliable mobile banking experience. It supports mobile check deposits. Customers find it easy to manage their accounts through the app.

3. US Bank: US Bank is a favorite. Its mobile app makes check deposits smooth. You can get instant access to your money for eligible accounts.

4. Axos Bank: Axos is easy to use. It offers a great mobile banking experience. You can deposit checks instantly and there are no monthly fees.

5. Discover Bank: Discover’s mobile app is highly rated. It supports online banking and has a competitive savings account. The mobile check deposit feature is a big plus.

6. Capital One: Capital One is known for making customers happy. Its mobile app gets a 4.9 on the App Store. It’s known for its great user experience and mobile check deposit features.

Bank Features Comparison Table:

| Bank | APY | App Rating (iOS/Android) | Mobile Check Deposit | Cut-off Times |

|---|---|---|---|---|

| SoFi | Variable | 4.8 / 3.8 | Yes | 3 PM PT |

| HSBC | Variable | 4.5 / 4.3 | Yes | 2 PM PT |

| US Bank | Variable | 4.6 / 4.4 | Yes | 4 PM PT |

| Axos Bank | Variable | 4.7 / 4.7 | Yes | 3 PM PT |

| Discover Bank | 3.75% | 4.8 / 4.4 | Yes | 5 PM PT |

| Capital One | Variable | 4.9 / 4.5 | Yes | 8 PM PT |

When comparing banks, look at fees and customer service too. The best mobile banking apps make managing money easier, thanks to features like mobile check deposit. These banks offer flexibility and accessibility for today’s banking needs.

Benefits and Drawbacks of Mobile Check Deposits

Mobile check deposits bring a lot of convenience to banking. They let users deposit checks anytime, anywhere, using a smartphone app. This saves time and makes managing money easier.

But, it’s important to know the downsides too. Sometimes, big checks or new customers might face delays. Also, funds might not be available right away. Banks might hold onto larger deposits for longer, affecting when you can use your money.

For a full picture, check out the pros and cons of mobile deposits. Knowing your bank’s rules can help a lot.

Mobile banking is getting safer, with better encryption and security features. Yet, there are limits on how much you can deposit. There’s also a risk of fraud and checks bouncing. It’s key to weigh these points to see if mobile deposits fit your banking style.