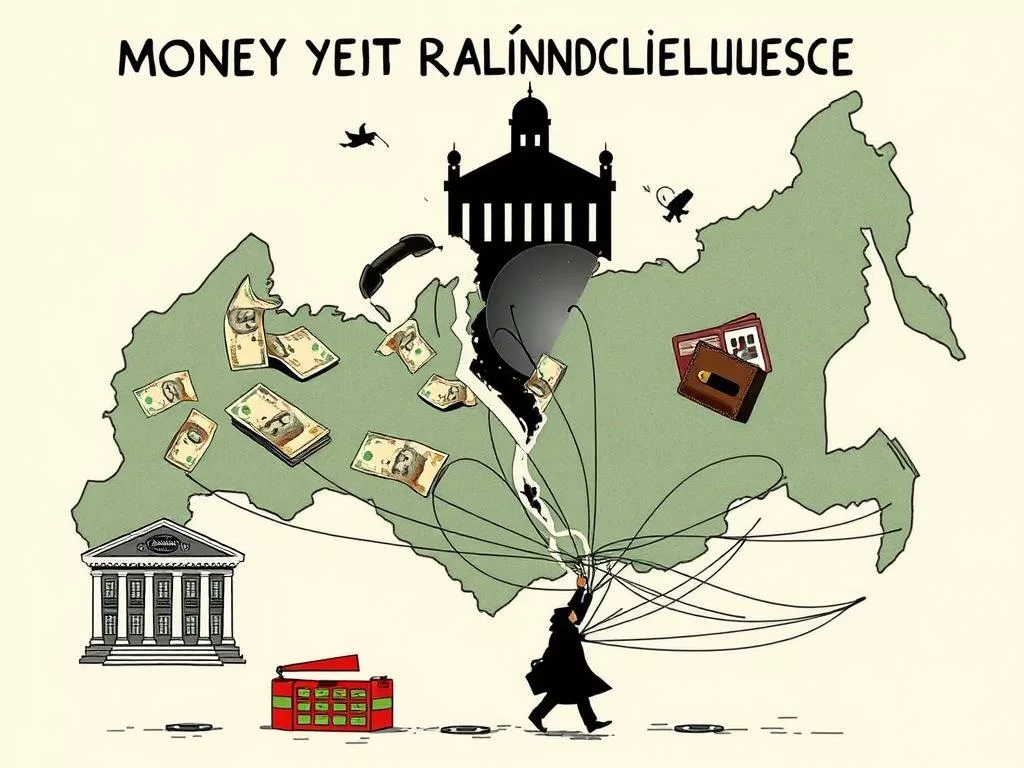

In today’s world, finding reliable ways to send money to Russia is key. Economic sanctions and tensions have made it hard to use services like Western Union. This has led to a search for new ways to send money.

Many countries, like Tajikistan, have faced problems with money transfers. Issues include error messages and blocks that make online payments hard. It’s important to look at each option carefully.

With many global companies stopping services to Russia, it’s tough to support family and friends. Knowing about money transfer services in Russia is more critical than ever.

This guide will help you find the best ways to send money to Russia. You’ll learn how to make smart choices during these challenging times.

Understanding the Current Money Transfer Landscape in Russia

The recent economic sanctions have greatly affected money transfer challenges in Russia. Traditional banking routes are now hard or impossible to use. This is because many Russian banks are banned from the SWIFT network. Companies like Western Union and MoneyGram have stopped their services to Russia, making it hard for people to send money.

As financial networks adjust to the sanctions, many are looking for new ways to send money. Sending international wire transfers can take 1-5 business days. Banks may charge $30-$50 for these transfers. This makes the process more expensive, with users possibly spending 5-7% more than with specialized services.

Looking into different payment methods is key for those wanting to help family in Russia. Specialized services can be safer, cheaper, and faster. But, they also face challenges due to current global tensions.

Many services, even those that offer fast transfers, have their own fees and limits. For example, PayPal charges 2.9% plus fixed fees for card transactions. Sending money through Western Union can cost $10 per transfer. These costs add up quickly, showing how complex it is to send money to Russia now.

| Service | Transfer Speed | Common Fees | Exchange Rate Markup |

|---|---|---|---|

| International Wire Transfer | 1-5 days | $30-$50 | 5-7% |

| PayPal | Instant | 2.9% + Fixed Fee | Variable |

| Western Union | Varies | Up to $10 | Variable |

| Specialist Providers | Varies | Varies | Lower than banks |

Understanding the money transfer challenges in Russia is key for anyone sending money. High fees, slow transfers, and complex rules make it hard. People have few but necessary options to send money.

Guide to Western Union Russia Alternatives

Looking for ways to send money to Russia without Western Union shows many options. Services like MoneyGram and Ria Money don’t work for Russia. PayPal, Google Pay, and Skrill also can’t send money there.

YooMoney and Koronapay are not active for sending money to Russia. But, Russian banks like Raiffeisenbank and UniCredit can send money to accounts in Russia. They charge high fees, up to 50%.

Cryptocurrency transfers in Russia are a good choice. For example, Bybit lets users send money with cryptocurrencies. This is a fast and cheap way to send money.

Profee is another option. It sends money from euros, dollars, or pounds to rubles without fees. Volet is a payment system that lets you send money to Visa or MasterCard in Russia. But, the recipient needs a Volet account to get the money.

Platforms like BestChange are also helping with money transfers to Russia. But, it’s important to be careful. The rules for sending money in Russia change often. Always check the latest information before sending money.

For more information on safe ways to send money, check out the best alternatives to Western Union today.

Evaluating the Best Options for Sending Money to Russia

When looking for the best way to send money to Russia, it’s key to compare services. Look at how fast, reliable, and affordable they are. Profee, Bybit, and BestChange are some top choices that offer different experiences and features.

With over 15 million users, services like Monito have saved people over $75 million. This shows how picking the right service can make a big difference.

Profee stands out for its good exchange rates and low fees, making it easy to use. Bybit, focused on cryptocurrencies, offers quick and cheap transactions but comes with risks due to price changes. It’s important to consider these risks when using peer-to-peer transactions.

Also, using Wise can lead to big savings, with over $70 billion in annual transfers. By looking at what each provider offers, you can choose the best one for you. Fast and reliable transfers are possible if you pick the right service.